August 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

August 15, 2023

Market Review

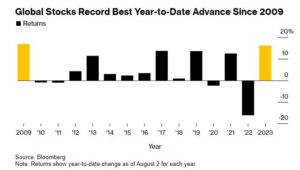

Global equity indices added to their solid first-half gains in July on optimism about slowing global inflation and a potential end to the Federal Reserve’s interest rate hikes. The MSCI World Index’s 16.2% YTD gain as of August 1 was its best performance for that period since 2009 (Figure 1).

The TSX Composite rose 2.3% in July, bringing its gain for the year to 6.4%. The index’s advance last month was led by a 21% surge in the healthcare sector, followed by materials (+6.4%), energy (+4.1%) and financials (+3.2%); the communication services sector was the worst performer with a 6.3% decline.

In the U.S., the S&P 500 rose 3.1% in July as all 11 sectors gained for the second straight month. The Nasdaq Composite tacked on 4.1% to its first-half gain of 31.7%, while the Dow Jones Industrial Average advanced 3.4%. Most European and Asian equity indices also gained in July after a strong first-half performance. (Data Source: FactSet).

Figure 1: Best YTD performance for global stocks since 2009

Our Strategy

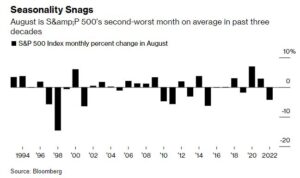

The TSX Composite and S&P 500 have both retreated more than 3% so far this month, justifying the August-September period as one of the worst for equity performance (Figure 2). With bond yields at multi-year highs amid stronger-than-expected economic and inflation data, investors’ risk appetite has also been impacted by macro events such as an ongoing slowdown in China and a currency devaluation in Argentina. The S&P 500 traded below its 50-day moving average for the first time in three months on August 15, while the TSX Composite’s 1.9% decline was its biggest daily drop in 10 months and took it below the pivotal 20,000 level.

Earlier this month, the Portfolio Management Team (PMT) undertook a full rebalance of all client portfolios, trimming gains from securities such as the Platinum Growth Fund (+15.5% YTD as of July 31) and allocating it to positions with significant long-term upside.

JNJ exchange offer for Kenvue: Luft Financial clients may have received a notice in the mail regarding an exchange offer by Johnson & Johnson (JNJ), a stock that is held in our client portfolios. JNJ is spinning off its consumer health business into a separate company named Kenvue (NYSE: KVUE, $23.26). Kenvue has a portfolio of products and brands that are household names, including Tylenol, Motrin, Benadryl, Neutrogena, Aveeno, Nicorette and Listerine. JNJ sold shares of Kenvue in an initial public offering in May 2023, and is now offering to exchange the 90% of Kenvue shares that it still holds for any or all shares of JNJ held by shareholders, as per the terms in the exchange offer document. The PMT has studied the exchange offer in detail and does not intend to exchange any of the JNJ shares currently held in client portfolios. The PMT believes that JNJ shares could benefit from a rerating of the company as a pure-play pharmaceutical business once the Kenvue spinoff is completed. Please contact your Luft Financial Advisor if you require additional information.

Figure 2: August Angst – this month is S&P 500’s second-worst in past three decades

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.