Summary – Risks are rising

Market Review: After an eventful first half that included a classic V-shaped rebound in Q2, the second half of the year got off to a sedate start in July, as equities rallied for the third month to reach new highs.

Outlook: While U.S. corporate earnings were better than expected in Q2, the second half of the year may put a dent in earnings as tariffs are implemented just as the economy is slowing down. Tariffs are back, and in our opinion, their negative impact is being underestimated as they will eventually affect consumer spending and economic growth. While economic growth is slowing in Canada and the U.S., central banks in both countries remain on hold, but interest rate cuts are likely in the second half.

Portfolio Strategy: The growing disconnect between the economy and equities is making us increasingly cautious, with part of our caution stemming from rampant bullishness that has resulted in the more speculative corners of the market outperforming broad indices. While markets have rebounded strongly from their April lows, we believe the risks of a near-term market pullback are rising from a combination of slowing economic growth, tariff uncertainty, and high valuations. Seasonal trends may also exert an influence on the markets.

As the market surge resulted in our equity allocation being well above target, we made a couple of tactical trades on July 22, trimming our U.S. holdings and allocating the proceeds to fixed income. Overall, our sense is that we are now transitioning to a period of greater uncertainty, one in which fixed income appears more attractive than equities, especially in the Canadian context.

The Portfolio Management Team’s (PMT) gameplan in the event of a 10% or greater correction remains unchanged – “buy the dip,” a strategy that has worked well in recent years, with most major declines proving to be quintessential buying opportunities. Our confidence in the strategy is boosted by our view that market declines could be capped by the prospect of not just a Federal Reserve Put, but also the Presidential Put.

Market Review – Third month of gains

After an eventful first half that included a classic V-shaped rebound in Q2, the second half of the year got off to a sedate start in July, as equities rallied for the third month to reach new highs. However, risk appetite waned in the last week of the month, before weak U.S. payroll data on August 1 triggered the biggest decline in North American equities in over three months.

Canada: The TSX Composite notched new highs during the month, peaking at 27,581 on July 30 (it has since reached a new record of 27,955 on August 6). The index rose 1.5% last month in a broad advance led by the communication services and technology sectors, bringing its YTD gains to 10.2% and outperforming the S&P 500 by 2.5 percentage points.

United States: Gains for the S&P 500 and Nasdaq Composite slowed in July after their stellar performance in the preceding two months. The S&P 500 rose 2.2% in July, reaching a record high of 6,427 on the last day of the month and taking its YTD gains to 7.8%, while the Nasdaq Composite’s 3.7% increase last month resulted in a YTD advance of 9.4%. The Dow Jones Industrial Average eked out a marginal gain of 0.08% in July for a YTD increase of 3.7%.

Two key take-aways here –

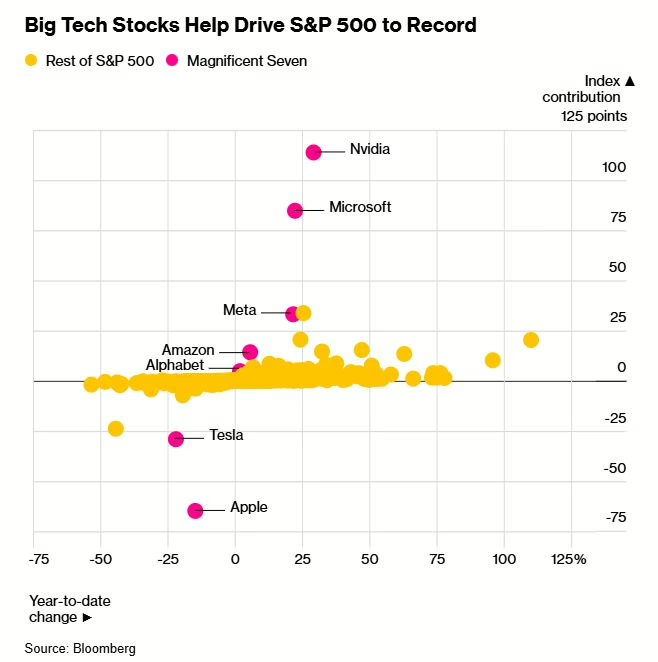

- Large-cap U.S. stocks have powered this year’s advance (Figure 1), as evidenced by the Russell 1000’s 7.7% gain (YTD – as of July 31, 2025), even as the small-cap Russell 2000 declined 0.8% for the year.

- With U.S. indices having caught up to most of their major global peers after the massive rebound since April, concerns about the end of U.S. “exceptionalism” that were rampant at the end of the first quarter have largely dissipated.

International: The Euro Stoxx 50 index rose 0.3% in July, bringing its YTD change to 8.7%, outperforming the S&P 500 by only 0.9 percentage point after beating it by over 16 percentage points (in USD terms) in Q1. Asian indices were broadly higher in July, led by Taiwan and Singapore, while India lagged with a 2.9% decline.

Overall, the MSCI AC World Index gained 2.1% in July as it rose to a new record during the month, for a YTD gain of 8.3%. (Sources: FactSet, Bloomberg)

Outlook – Equities could hit a wall as risks rise

In last month’s report, we had sought to answer the trillion-dollar question – why equity indices were making new highs despite the plethora of risks that should affect investor sentiment. The short answer was that equities were effectively scaling the “Wall of Worry” because corporate earnings were holding up and tariff headlines were being ignored. But at some point, equities could hit a wall and retreat as risks coalesce, and sentiment moves to “risk off.” We discuss below some of the key issues that could affect the near-term outlook:

- Q2 U.S. corporate earnings have been better than expected: As noted in our previous report, Q2 earnings were expected to provide a reality check about the viability of forward earnings estimates, given the heightened uncertainty that has bedeviled markets and companies this year. But the earnings news so far has been unexpectedly positive. According to Bloomberg Intelligence, Q2 earnings for S&P 500 companies that have reported so far are up 9.1%, triple the pre-season forecast. FactSet notes that with more than two-thirds of the S&P 500 having reported, both the percentage of companies reporting positive earnings surprises and the magnitude of earnings surprises are above their 10-year averages. That said, the second half of the year may put a dent in earnings as tariffs are implemented just as the economy is slowing down.

- Tariffs are back: The tariffs are back, after President Trump unveiled a raft of new tariffs on July 31, with most of them expected to take effect after midnight on August 7. But investors are choosing to ignore their undoubtedly adverse impact for the moment, even though the average U.S. tariff is now expected to rise six-fold to 15.2% (from 2.3% a year ago). Most nations face tariffs on their exports to the U.S. of between 10% and 15%, although some nations such as Canada and India have much higher tariffs. Canada’s tariff has been set at 35%, although economists’ expect the effective rate to be between 6% and 7% because of exemptions under the CUSMA agreement. India’s tariff has just been doubled to 50% over its ongoing purchases of Russian oil, which the U.S. maintains is helping Russia sustain its war against Ukraine. In our opinion, the negative impact of tariffs is being underestimated, as they will eventually affect consumer spending and economic growth.

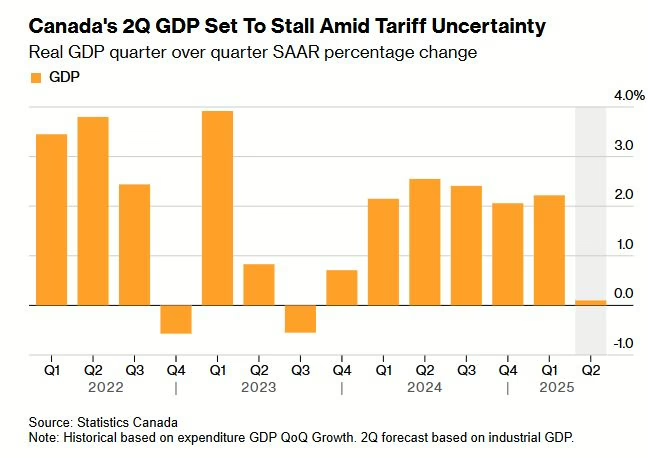

- Growth is slowing….: The latest data indicate that U.S. growth may be slowing. The payroll numbers on August 1 were concerning – the U.S. economy added 73k jobs in July (almost all of them in low productivity sectors like health care and social assistance), lower than expectations for a 104k increase, while payroll numbers for the previous two months were revised lower by a whopping 258k. This means that jobs growth in the past three months has averaged about 35k, the lowest since the pandemic. As well, a report on August 5 showed that the U.S. services sector stagnated in July. The ISM index of services missed all estimates by declining to 50.1, while a measure of prices paid for materials and services climbed to the highest since October 2022, signalling that inflationary pressures persist. In Canada, the economy practically stalled in the second quarter, with output on track to expand at an annualized pace of just 0.1% (Figure 2). However, since that sluggish number is distinctly better than the Bank of Canada’s forecast for a 1.5% contraction in Q2 and a Bloomberg survey estimate of a 0.8% decline, many economists are of the view that the Canadian economy is no longer deteriorating as much as feared earlier.

- …….but central banks remain on hold: The Bank of Canada (BoC) and the Federal Reserve both held their benchmark rates unchanged on July 30. The BoC struck a dovish tone while holding rates steady for the third successive meeting, citing the uncertainty from U.S. tariffs, but reiterated that more rate cuts may be needed if the economy weakens and inflation stays in check. As for the Federal Reserve, its resolve to hold off on cutting interest rates because of the uncertain impact of tariffs on inflation may be tested by data like the July jobs report, which many believe could signal a turning point for the U.S. economy. Money markets are now pricing in two U.S. rate cuts this year, with an 80% chance of a reduction in September.

- Why geopolitical risks continue to be ignored: Investors were rattled on August 1 not just by the weak jobs report, but also by a sudden eruption of tension between the U.S. and Russia, after Trump said the U.S. was moving two nuclear submarines in response to “highly provocative” statements from former Russian President Medvedev. That bout of concern subsided quickly, as investors piled back into equities on August 4. As we noted last month, the military conflicts that broke out in Q2 (India-Pakistan, Israel-Iran) did little to impact market sentiment. The point is, horrific as these conflicts are in terms of human lives and suffering, their financial impact is often limited unless they affect the economic fundamentals of the global economy – like the Covid pandemic or the initial tariff shock in April – as Goldman Sachs strategists point out in a recent New York Times op-ed. The strategists note that markets are innately resilient, and not every headline-grabbing geopolitical event will create a lasting shock. Our advice in such situations is to make a reasoned decision after assessing the impact of the event, instead of a knee-jerk decision to “get out of the market” that may result in inadvertently missing the turnaround and subsequent gains.

Portfolio Strategy

The flurry of changes we made in Q2 positioned client portfolios adequately to benefit from the continued run-up in the markets. However, the growing disconnect between the economy and equities is making us increasingly cautious.

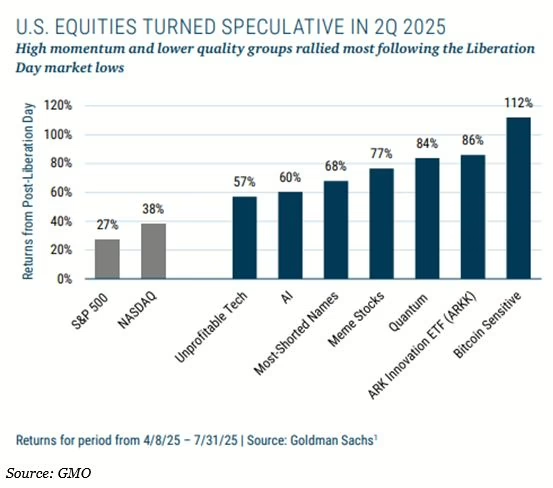

Part of our caution stems from rampant bullishness that has resulted in the more speculative corners of the market – for example, meme stocks or the most heavily shorted names (Fig. 3) – outperforming broad indices. Meme stocks made a brief comeback in the second half of July, exemplified by the surge in beaten-down companies such as Opendoor Technologies and Kohl’s Corp, although the scale of speculation was nothing like the original meme frenzy in 2021 involving a handful of stocks including GameStop and AMC. These “dash to trash” speculative episodes generally do not end well.

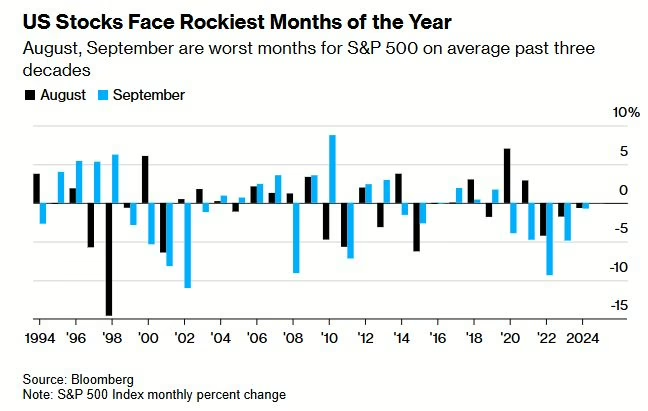

While markets have rebounded strongly from their April lows, we believe the risks of a near-term market pullback are rising from a combination of slowing economic growth, tariff uncertainty, and high valuations. Seasonal trends may also exert an influence on the markets, since the late summer months tend to be unusually volatile, with August and September being the worst months for average monthly performance over the past three decades (Fig. 4).

As the market surge resulted in our equity allocation being well above target, we made a couple of tactical trades on July 22, trimming our U.S. holdings via the RBC Quant US Dividend Leaders ETF (RUD) and allocating the proceeds to the CIBC Core Fixed Income Pool (CCRE). This rebalancing brought our asset mix closer to target while reducing our exposure to equity market risk.

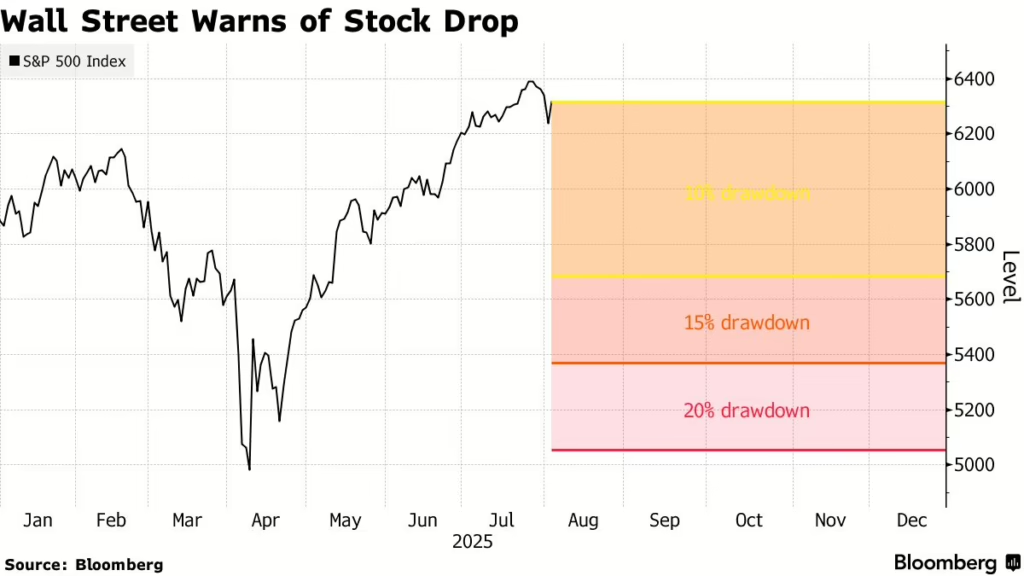

We had noted last month that we expected a market pullback in the second half of the year, although we were uncertain of its magnitude. A growing number of strategists on Wall Street have a similar opinion (Fig. 5), based on the combination of factors discussed earlier.

Overall, our sense is that we are now transitioning to a period of greater uncertainty, one in which fixed income appears more attractive than equities, especially in the Canadian context. With the TSX Composite soaring to new highs even as the Canadian economy stumbles and tariffs affect global growth, the risk-reward payoff for Canadian stocks is not as appealing as it is for fixed income, which should benefit from interest rate cuts in the months ahead.

The Portfolio Management Team’s (PMT) gameplan in the event of a 10% or greater correction remains unchanged – “buy the dip,” a strategy that has worked well in recent years, with most major declines proving to be quintessential buying opportunities. Our confidence in the strategy is boosted by our view that market declines could be capped by the prospect of a Federal Reserve Put* (political pressure may result in the pace of rate cuts being stepped up), in addition to the Presidential Put (bullish comments or posts on social media). (*“Put” is an option term – in this specific case, it refers to the belief held by many that if there is a large downturn in the economy or markets, the Federal Reserve will come to the rescue with stimulus measures like interest rate cuts).

The PMT will continue to make incremental changes to client portfolios to position them for changes in the markets and economy. The subject of hedging currency exposure, while not a major risk for our client portfolios, is one that is currently being debated by the PMT, since recent events have raised the possibility of the US dollar entering a phase of secular decline.

To accompany this Portfolio Management Update, we’ve posted our latest video, Rising Risks. In this video, Elvis Picardo discusses the risks that could derail the markets’ relentless rally and the strategy to be implemented in case of a pullback.

Watch the video: Rising Risks – Luft Financial Video (4 mins)

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee their accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.