February 2021 Portfolio Management Team Update

Market & Economic Environment

The record-setting rally in global equities came to a temporary halt in the last week of January, as stocks posted their worst weekly performance in three months. Investors were unnerved by surging prices for the most heavily shorted stocks like GameStop, on concern that hedge funds would have to reduce their market exposure by trimming their long positions. Risk appetite was also dampened by the slow rollout of Covid-19 vaccines worldwide as well as the spread of more infectious variants of the virus in some countries.

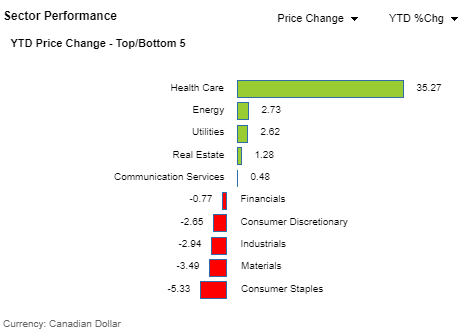

The TSX was marginally lower at -0.55% in January, as gains by some sectors were not enough to offset declines in groups such as materials, industrials, and financials (see Chart below). Health care was the standout performer, as the pharmaceutical sub-sector soared 46% on optimism for wider legalization of cannabis companies in the U.S. The energy group also gained as crude oil prices advanced for the third month.

The S&P 500 fell 1.1% in the month, while the Dow Jones Industrial Average fell 2.0% and the Nasdaq Composite managed to finish in positive territory with a 1.4% gain. There was significant divergence in the performance of small and large companies, with the Russell 2000 index – a proxy for small-cap companies – gaining 5.0% in January while the large-cap Russell 1000 fell 0.9%.

(Data Source: FactSet)

Our Strategy

The “reflation” trade was fully in evidence last month, as bond yields rose and investors piled into cyclical and small-cap stocks, on expectations for faster economic growth. The rise in U.S. bond yields now has some economists concerned that inflation may pick up from the combination of a strengthening economy and another massive stimulus package.

The Portfolio Management Team (PMT) believes that the outlook for equities remains favourable, with numerous companies having reported solid earnings growth and issuing positive guidance for the rest of 2021. The PMT is also optimistic that pandemic-related news flow will finally turn positive in the weeks ahead, as the vaccine rollout picks up momentum across many nations. Given the upward trend in the markets, the PMT has invested contributions made by clients to their RRSP and TFSA accounts as expeditiously as possible.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

October 2024 Portfolio Management Team Update

October 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth October 3, 2024 Market Review Global equities advanced to new highs last month to cap a volatile quarter, as interest rate cuts by major central banks boosted optimism for a soft landing despite mixed economic data. The TSX […]

Read more

September 2024 Portfolio Management Team Update

September 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth September 24, 2024 Market Review Global equities added to gains in August, as they recovered from the worst bout of volatility since 2022 that erupted in the first week of the month. The TSX advanced 1.0% last […]

Read more

August 2024 Portfolio Management Team Update

August 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth August 13, 2024 Market Review Global equities surged to new highs in July as inflation concerns abated, before the worst bout of volatility since 2022 erupted in the first week of August, taking the S&P 500 to the […]

Read more