July 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

July 26, 2023

Market Review

Global equity indices rebounded in June, as economic data that suggested resilience in the U.S. economy raised investors’ hopes for a “soft landing” (which is defined as a slowdown in economic growth that avoids recession).

The TSX Composite’s advance of almost 3.0% last month pared its May decline of 5.2% and took the index into positive territory for the second quarter, with a gain of 0.3%. The index’s gains in June were broad-based, with 8 of its 11 sectors in the black, led by the consumer discretionary (+8.8%), industrials (+4.6%), technology (+4.3%), financials (+4.0%), and energy (+3.1%) sectors. The technology sector was by far the best-performing group in the first half of 2023, with a 47.4% surge.

The S&P 500 surged 6.5% in June as the market rally broadened to include all 11 sectors; the index was up 8.3% in Q2. The best performers last month were very similar to the TSX: consumer discretionary (+12.0%), industrials (+11.2%), materials (+10.8%), technology (+6.6%), financials (+6.5%), and energy (+6.5%). The Nasdaq’s 6.6% advance in June took its Q2 gain to 12.8%, while the Dow Jones Industrial Average’s 4.6% increase enabled it to post a 3.4% gain in the quarter.

The TSX Composite’s first-half 4.0% increase lagged the huge gains posted by the S&P 500 and Nasdaq Composite of 15.9% and 31.7% respectively over this period. Powered by the runaway performance of seven of its biggest stocks (Apple, Alphabet, Meta Platforms, Microsoft, Nvidia, Amazon and Tesla), the Nasdaq-100 racked up a record first-half gain of 38.8%.

Most European and Asian equity indices also advanced in June to cap a strong first-half performance. Globally, some of the best performers among major international markets in the first half of 2023 included Japan (+27.2%), Taiwan (+19.7%), Germany (+16.0%) and France (+14.3%). (Data Source: FactSet).

Our Strategy

Despite rate hikes by the Bank of Canada and Federal Reserve this month, market strength in recent months suggests that investors are pinning their hopes on a soft landing in the U.S. economy.

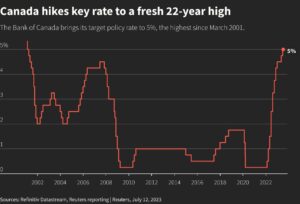

The Bank of Canada, which had unexpectedly restarted its monetary tightening campaign with a 25 basis-point increase on June 5, hiked the benchmark interest rate by a similar amount on July 12, taking it to a 22-year high of 5.0% (Figure 1). While the rate increase was widely expected, the Bank said it could raise rates further because of the risk of inflation stalling above its 2% target.

Figure 1: Bank of Canada’s latest hike takes overnight rate to highest in over two decades

On July 26, the Federal Reserve also boosted its benchmark rate as expected by 25 basis points to a target range of 5.25% – 5.50%. This was the 11th increase since March 2022, when the rate was close to zero, and took the benchmark rate to the highest level since 2001. In the press conference following the rate announcement, Fed chairman Powell said that the central bank’s staff are no longer forecasting a recession because of recent resilience in economic data, although they are still forecasting a noticeable slowdown in growth later this year.

We are somewhat concerned about the fact that notwithstanding a likely economic slowdown, the S&P 500 is just 5.5% away from its record high of 4,818 reached in January 2022. In addition, while market breadth has been improving of late, the index’s advance is still being largely led by the seven mega-caps mentioned earlier.

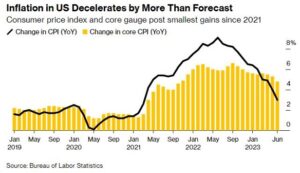

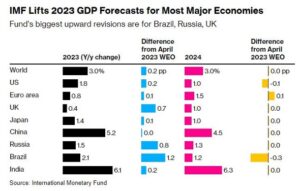

On a positive note, the global economy seems to be recovering as inflation decelerates (Figure 2) and investors look forward to the end of the most aggressive cycle of interest rate increases in decades. On July 25, the International Monetary Fund (IMF) raised its outlook for the global economy this year (Figure 3), as risks diminished following the resolution of the USD debt ceiling impasse and quick action by authorities to stave off a potential banking crisis. The IMF estimates that global GDP will increase 3% in 2023, an increase of 0.2 percentage points from its April forecast, while the 2024 forecast was unchanged at 3.0%.

Figure 2: US inflation is decelerating

Figure 3: IMF increases global growth forecast

Although slower than last year’s global expansion of 3.5%, stable growth may spur rotation into cyclical sectors like financials, energy and materials that constitute 61% of the TSX. Historical evidence also supports the view that a strong first half for US equities generally carries over into the second half of the year. That said, since interest rates affect the economy after a lag of several months, we are monitoring the ramifications of the steep rate hikes on Canadians’ pocketbooks, as growing evidence points to a significant proportion of mortgage payers being financially stretched.

Our asset allocation in client portfolios has been unchanged this year. In the second quarter, we made changes to the “alternatives” sleeve of our model portfolio by exiting our full position in a hedge fund and deploying the proceeds in two leading liquid alternative ETFs. Last month, pursuant to the recommendations of the Investment Committee of the Platinum Growth Fund, changes were made by the investment fund manager (Majestic Asset Management) to the U.S. sleeve of this fund. The Platinum Growth Fund was up 12.9% in the first half of 2023 and has gained 15.1% YTD (as of July 26, 2023). (Please contact your Luft Financial Advisor if you require additional information).

The Portfolio Management Team (PMT) intends to undertake a full rebalance of client portfolios imminently; a rebalance will redeploy capital from positions with substantial gains into positions where the PMT sees significant value and long-term upside.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.