Summary

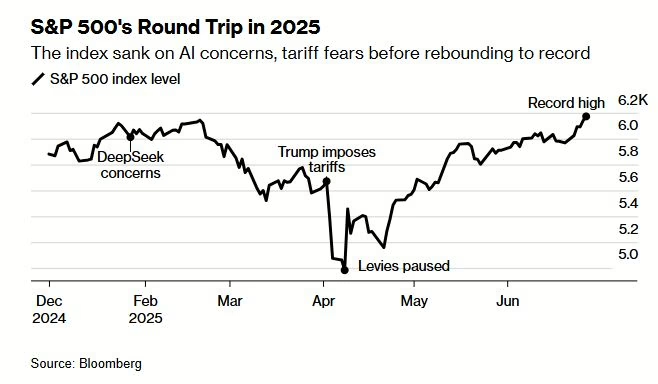

Market Review: Global equities staged a stunning turnaround in Q2, a performance that was all the more remarkable considering that the quarter commenced with the biggest slide in U.S. markets since the 2020 pandemic. President Trump’s announcement of a 90-day moratorium on tariffs on April 9 jump started a historic turnaround and an ongoing rally that has powered equity indices to new record highs.

Economic Outlook: Why are equity indices making new highs even though there are plenty of risks that should affect investor sentiment, including a slowing global economy, renewed trade tensions, and military conflicts in parts of the world? Markets have effectively scaled the proverbial “Wall of Worry” because corporate earnings have held up, and tariffheadlines seem to have lost their shock value.

The heightened levels of complacency and risk appetite at a time when economic fundamentals appear to be deteriorating makes us a little nervous. This disconnect is especially apparent in Canada, where incoming data are already reflecting the destructive impact of U.S. tariffs.

Portfolio Strategy: The Portfolio Management Team (PMT) made multiple changes to client holdings and portfolios in Q2, in response to rapidly evolving market conditions. These changes have benefited client portfolios by enhancing global diversification, lowering overall portfolio volatility, and reducing manager / concentration risk.

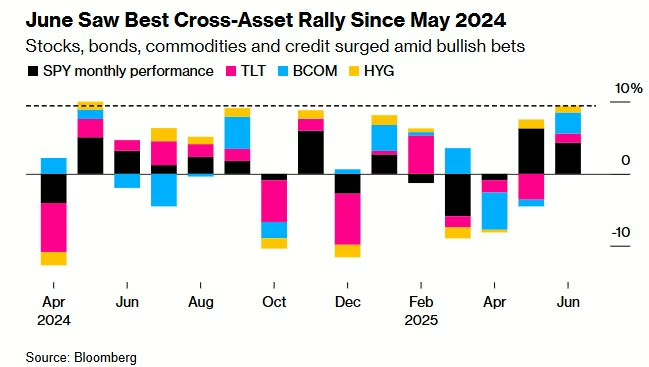

Our diversified portfolios are performing well, as multiple asset classes recorded their best performance in just over a year in June. We expect a market pullback of some sort in the second half of the year, although we are uncertain of its magnitude. With North American indices at all-time highs, our portfolio positioning might move to a slightly more defensive tilt, compared with the current neutral stance.

We currently see opportunity in Canadian fixed income, based on our view that the Bank of Canada (BoC) may cut rates in the months ahead. Our growing caution on the near-term outlook for equities is somewhat tempered by the bullishness of strategists at leading Wall Street firms.

In the event of a notable pullback in the volatile summer months, we would rebalance all portfolios to “buy the dip,” a strategy that has worked well in recent years. While our client portfolios are participating in most of the markets’ upside, at the present time, we think greater vigilance is called for to cushion portfolios on the downside.

Market Review – Q2 rebound leads to new highs

Few could have foreseen the stunning turnaround in global equities in Q2, especially after the quarter commenced with the biggest slide in U.S. markets since the 2020 pandemic, following President Trump’s unveiling of reciprocal tariffs on April 2. A week later, Trump’s announcement of a 90-day moratorium on tariffs jump started a historic turnaround and an ongoing rally that has powered equity indices to new record highs (Figure 1).

Canada: The TSX Composite has also been front-and-centre in the equity rally, steadily marching to new highs as it crossed the 27,000 level for the first time earlier in July. The index rose 2.6% last month, bringing its Q2 gains to 7.8%, its best quarterly performance in four years. All 11 sectors on the TSX gained in Q2 in a broad-based advance, led by the technology, consumer discretionary, and financials sectors.

United States: The S&P 500’s 5% advance in June, on the heels of a 6.2% surge in May, enabled the index to post a 10.6% gain in Q2, its best performance since Q4 of 2023. The Nasdaq Composite went one better, with a 6.6% advance in June that gave it a Q2 gain of 17.8%, its best quarter in five years. The Dow Jones Industrial Average had a more sedate performance, rising 4.3% in June for a Q2 gain of 5.0%; it has yet to reclaim its record high of just over 45,000 set in January.

International: Elsewhere, European indices took a breather in Q2, after the pan-European Stoxx 600 index outperformed the S&P 500 by a record 17 percentage points in Q1. The Euro Stoxx 50 index retreated 1.2% in June, for a Q2 gain of just 1.0%. This tepid performance resulted in its margin of outperformance vs. the S&P 500 shrinking to 2.8 percentage points as of June 30 (8.3% vs. 5.5% YTD), compared with over nine percentage points just a month earlier. Germany’s DAX index was the standout performer among European indices in Q2 as well, with a gain of 7.9% following a Q1 surge of 11.3%. Asian indices were broadly higher in Q2, led by Japan, Australia, India and Taiwan.

Overall, the MSCI AC World Index rose 3.8% in June for a Q2 gain of 8.8%, its best quarterly performance in over a year, closing out the quarter at a new record high.

(Sources: FactSet, Bloomberg)

Economic Outlook – Scaling the “Wall of Worry”

Recent market strength begs the question – why are equity indices making new highs even though there are plenty of risks that should affect investor sentiment, including a slowing global economy and renewed trade tensions? Not to mention military conflicts that continue to erupt across parts of the world – in addition to the ongoing Russian assault on Ukraine, Q2 also saw the worst skirmish between India and Pakistan in decades, as well as the attack by Israel (and the U.S.) on Iran’s nuclear facilities.

Primary reasons why markets have effectively scaled the proverbial “Wall of Worry” include –

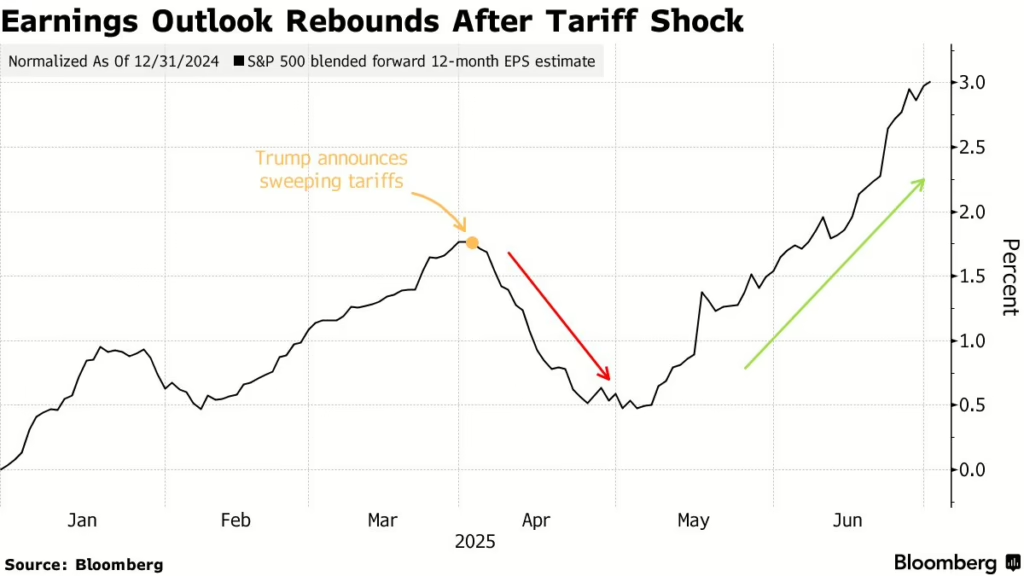

- Corporate earnings have held up: Earnings are the biggest driver of the stock market; while the earnings outlook deteriorated after the tariffs were announced in April, the forecast has improved substantially over the past three months (Figure 2). The “Magnificent 7” led U.S. earnings growth in Q1, posting growth of 27.7%, compared with average earnings growth of 9.4% for the other 493 companies in the S&P 500. Earnings estimates for the S&P 500 are quite optimistic, with earnings growth forecast at 9.4% for this year, and at about 14% in 2026 (source: FactSet). Against this backdrop, the upcoming Q2 “earnings season” – which commences around mid-July – should provide a reality check about forward earnings estimates.

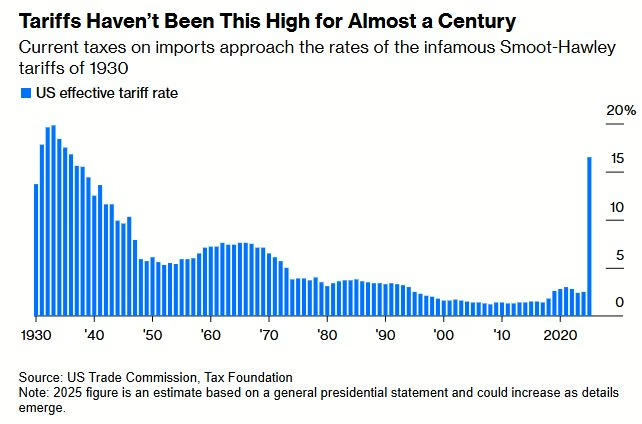

- Tariff headlines are being ignored: Tariff headlines seem to have lost their shock value, with investors focusing on the overall extension of the tariff deadline to August 1 (from July 9). Widespread expectations that negotiations between the U.S. and its trading partners will result in amicable tariff agreements may be misplaced, in our view, given the unpredictable and arbitrary nature of the tariff announcements. At the time of writing, President Trump has just threatened to increase tariffs on some Canadian goods to 35% (from 25%) and is considering blanket tariffs of 15% to 20% on most trading partners, compared with the current global baseline minimum tariff of 10%. The effective U.S. tariff rate is currently the highest in almost a century (Figure 3).

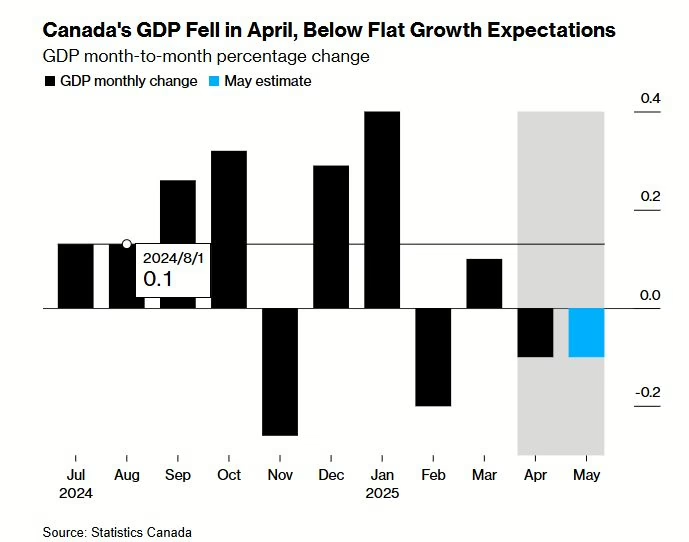

The heightened levels of complacency and risk appetite at a time when economic fundamentals appear to be deteriorating makes us a little nervous. This disconnect is especially apparent in Canada, where incoming data are already reflecting the destructive impact of U.S. tariffs. The Canadian economy has recorded four straight months of nominal job gains or outright losses, while the unemployment rate is at a multi-year high of 7%. Total exports fell 10.8% in April, the biggest percentage drop since December 2008.

The Canadian economy shrank 0.1% in April and May (Figure 4), keeping it on track for an annualized 0.3% contraction in Q2, a marked deceleration from Q1’s 2.2% expansion, but significantly better than the Bank of Canada’s pessimistic forecast of a 1.3% decline.

Portfolio Strategy

The Portfolio Management Team (PMT) made multiple changes to client holdings and portfolios in Q2, in response to rapidly evolving market conditions.

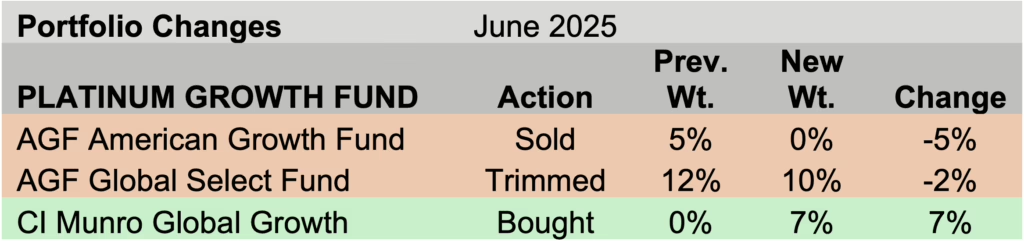

Portfolio changes – June 2025

Last month, in the Platinum Growth Fund, we sold our position in the AGF American Growth Fund and trimmed our allocation to the AGF Global Growth Fund by a couple percentage points to 10%. Proceeds of these sales were primarily allocated to the CI Munro Global Growth Fund (Table 1), a top performing fund with a global mandate.

We sold / trimmed the AGF fund holdings because of a substantial overlap (>50%) between the two AGF funds, which can lead to concentration risk. The recent retirement of long-term AGF fund manager Tony Genua also created a degree of uncertainty about the funds’ future performance, in our opinion.

*Portfolios weights are approximate

Portfolio changes – April 2025

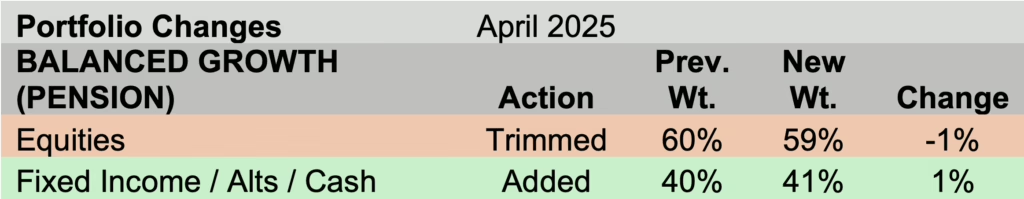

On April 30, we rebalanced all client portfolios, using the equity rebound as an opportunity to marginally trim our equity allocation (Table 2). For example, in our Pension (Balanced Growth) portfolio, we trimmed overall equity allocation by a percentage point to 59%, with proceeds allocated to cash and fixed income.

*Portfolios weights are approximate

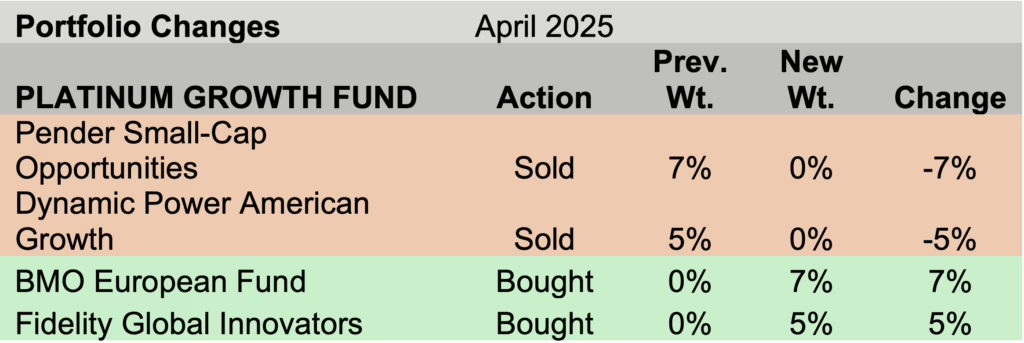

Earlier in April, we also made some significant changes within the Platinum Growth Fund, replacing the Pender Small-Cap Opportunities Fund and Dynamic Power American Growth Fund with BMO European Fund and Fidelity Global Innovators (Table 3).

*Portfolios weights are approximate

Portfolio Impact

The changes made in Q2 have benefited client portfolios in the following ways –

- Enhanced global diversification: Within the equity sleeve, our U.S. allocation has been reduced to 55% (from 50%), while international allocation has been boosted to 20% (from 15%). This has mitigated U.S.-specific risks within the portfolios and has improved potential long-term returns through increased exposure to regions such as Europe, which continues to trade at better valuations than the U.S.’s rich multiples.

- Lowered portfolio volatility: We believe the uncertain economic environment poses challenges for Canadian and U.S. small-cap stocks. Rotating from the volatile small-cap sector into large-cap funds has lowered overall portfolio volatility.

- Reduced manager / concentration risk: In April, the PMT decided to cap allocations to individual fund managers at 10%, thereby reducing manager / concentration risk.

Looking forward

Our diversified portfolios are performing well, as multiple asset classes recorded their best performance in just over a year in June (Figure 5).

We expect a market pullback of some sort in the second half of the year, although we are uncertain of its magnitude. With North American indices at all-time highs, our portfolio positioning might move to a slightly more defensive tilt, compared with the current neutral stance.

We currently see opportunity in Canadian fixed income, based on our view that the Bank of Canada (BoC) may cut rates in the months ahead. BCA Research said in a recent report that the stronger Canadian dollar and tightening financial conditions point to further easing by the BoC, making Canadian bonds attractive. Note that the Bank of Canada held its key interest rate at 2.75% for the second successive meeting on June 4 but said that a rate cut may be necessary if the economy weakens and inflation remains contained.

Our growing caution on the near-term outlook for equities is somewhat tempered by the bullishness of strategists at leading Wall Street firms. This week, strategists at Goldman Sachs raised their year-end target for the S&P 500 to 6,600 (from 6,100) and boosted their 12-month forecast to 6,900 (from 6,500). Bank of America strategists also upped their year-end target to 6,300 (from 5,600) and set a 12-month target of 6,600.

In the event of a notable pullback in the volatile summer months, we would rebalance all portfolios to “buy the dip,” a strategy that has worked well in recent years. We will continue to rebalance your portfolios as we adjust to changes in the markets and economy. While our client portfolios are participating in most of the markets’ upside, at the present time, we think greater vigilance is called for to cushion portfolios on the downside.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.