June 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

June 22, 2023

Market Review

Most global equity indices retreated in May, as concern about a slowing global economy and uncertainty about the future path of interest rates sapped investor sentiment.

The TSX Composite tumbled 5.2% last month, its biggest monthly decline since December, paring its year-to-date gain to just below 1%. The index’s decline was broad-based, with 10 of its 11 sectors in the red, led by materials (-10.7%), energy (-8.4%), communication services (-8.2%) and financials (-5.4%); the technology sector was the only exception with a gain of 10.1%, bringing its YTD gain to over 40%.

In the U.S., the S&P 500 rose 0.25% while the Dow Jones Industrial Average fell 3.5% in May. The Nasdaq Composite surged 5.8%, powered by the technology mega-caps that are believed to be in the vanguard of the artificial intelligence (AI) race. Most European and Asian equity indices posted significant declines in May, although some major markets such as Japan (+7.0%), Taiwan (+6.4%), Brazil (+3.7%) and India (+2.5%) bucked the downward trend. (Data Source: FactSet).

Our Strategy

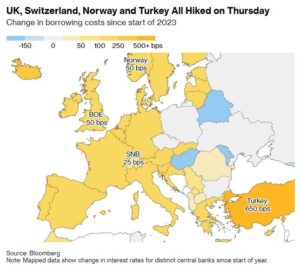

Interest rate concerns are front-and-centre once again, after as many as four nations hiked their benchmark rates on June 22 (Figure 1) to counter stubbornly high inflation. These concerns have been growing since June 7, when the Bank of Canada unexpectedly restarted its monetary tightening campaign, saying excess demand in the economy appeared to be more persistent than expected. The 25 basis-point increase by the BoC took the overnight lending rate to 4.75%, the highest in over two decades. A week later the Federal Reserve paused its tightening campaign after 15 months of rate hikes but signaled that two more rate increases are likely; the media promptly deemed this as a “hawkish pause.”

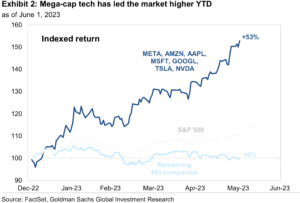

The technology mega-cap companies that dominate the U.S. indices have proved to be immune to these rate-hike fears so far, as blowout quarterly earnings by Nvidia and Microsoft have added fuel to the AI hype. The “Magnificent Seven” – Apple, Alphabet, Meta Platforms, Microsoft, Nvidia, Amazon and Tesla – which collectively had a 26% weight in the S&P 500 as of mid-May, accounted for almost all the index’s gains as of that date; excluding these seven stocks, the index would have been down 0.8% for the year through May 16 (Figure 2).

Such narrow “breadth” can be dangerous because it can hugely influence the overall direction of the market, both on the upside (as is the case currently) and on the downside (as in 2022). The AI craze has opened up a massive performance gap not just between U.S. large cap and small cap stocks, but also between the U.S. and Canada (the TSX only has an 8% weighting in technology, compared with 28% for the S&P 500). As of June 22, the performance differential between the large-cap Russell 1000 and Russell 2000 was 10 percentage points (+13.5% vs. +3.4%), while that between the S&P 500 and TSX Composite was about 13 percentage points (+14.1% vs.1.0%).

Figure 1: Four nations hiked rates on June 22, 2023

Figure 2: “Magnificent Seven” dominate S&P 500 gains YTD

With the S&P 500 trading at a 14-month high of over 4,400 earlier this month and the Nasdaq Composite up 30% YTD, the Portfolio Management Team (PMT) decided it was an opportune time to make some changes in the U.S. sleeve of our Platinum Growth Fund. Specifically, we exited our entire position in the TS US Blue Chip Equity Fund and allocated the proceeds to two leading equity funds and an exchange-traded fund (ETF).

The TD US Blue Chip Fund was one of the biggest constituents of the Platinum Growth Fund with a 20% weight. While it has been a stellar performer in good years, it has a close correlation with the Nasdaq-100 index. As the fund had gained 29% as of June 16, we opted to sell the fund position because of our concern that the technology rally was overextended and could run out of momentum.

The proceeds from this fund sale were allocated to two top-performing U.S. equity funds – the NBI US Equity Fund (10%) and the AGF American Growth Class (5%). The balance 5% was allocated to the Nasdaq-100 Index ETF (QQC) that trades on the TSX exchange, as the PMT desired to retain some exposure to the U.S. technology sector.

The PMT believes the new allocation will significantly reduce concentration risk in mega-cap technology and provide better diversification of portfolio holdings and manager strategies within the Platinum fund, reducing volatility and potentially providing better risk-adjusted returns.

The PMT is also reviewing the global and Canadian equity sleeves within the Platinum Growth Fund and expects to make some changes shortly. The PMT continues to see outstanding value in many of its individual stock positions and intends to undertake a full rebalance of client portfolios in the summer months to capitalize on the many buying opportunities currently available.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.