(This article was written on March 25, 2020; all market data is of close on that date).

Former U.S. Federal Reserve chairman Ben Bernanke immortalized the term “green shoots,” when he used it to refer to a nascent recovery in the American economy on March 12, 2009, literally days after U.S. stocks bottomed and the record bull market got underway.

At the present time, while green shoots may be all over the terrain as spring commences in earnest, they have been extremely elusive in financial markets due to the horrific damage inflicted by the coronavirus. Globally, trillions in household wealth has been vaporized, with millions of people out of work and businesses in the tens of thousands facing financial pressures.

However, some encouraging developments this week just might suggest that some tentative shoots are beginning to poke through the charred financial landscape.

In our March 18 Macroscope, we had noted that markets would be close to bottom when a sustainable rally sets in despite the endless barrage of bad news, coupled with some positive news flow that indicates the pandemic may be coming under control.

A Bloomberg article (1) this week cited the following metrics identified by strategists as necessary for a market turnaround (listed in random order):

1. A peak in new coronavirus cases;

2. Two or three straight days of gains for equities;

3. Stabilization in funding markets;

4. Substantial fiscal packages (big enough to avert mass bankruptcies and support laid-off workers);

5. A pharmaceutical breakthrough or solution to the coronavirus.

Gauging progress against that checklist depends on whether one is a glass-half-empty or half-full kind of person. While Europe may be nearing its peak in new cases, these could be weeks away in North America. Therapies to combat the coronavirus are still months away, although at this point, any medications that show some efficacy against the virus would be a huge positive.

For the glass-half-full crowd, there’s the fact that U.S. indices registered back-to-back gains on March 24-25, the first two-day rally since February 12. Canada is rolling out massive fiscal stimulus, while the U.S. is on the verge of unveiling a record $2-trillion stimulus package. The Federal Reserve has also introduced unprecedented measures to alleviate stresses that are currently the highest since the 2008-09 financial crisis in funding and financial markets.

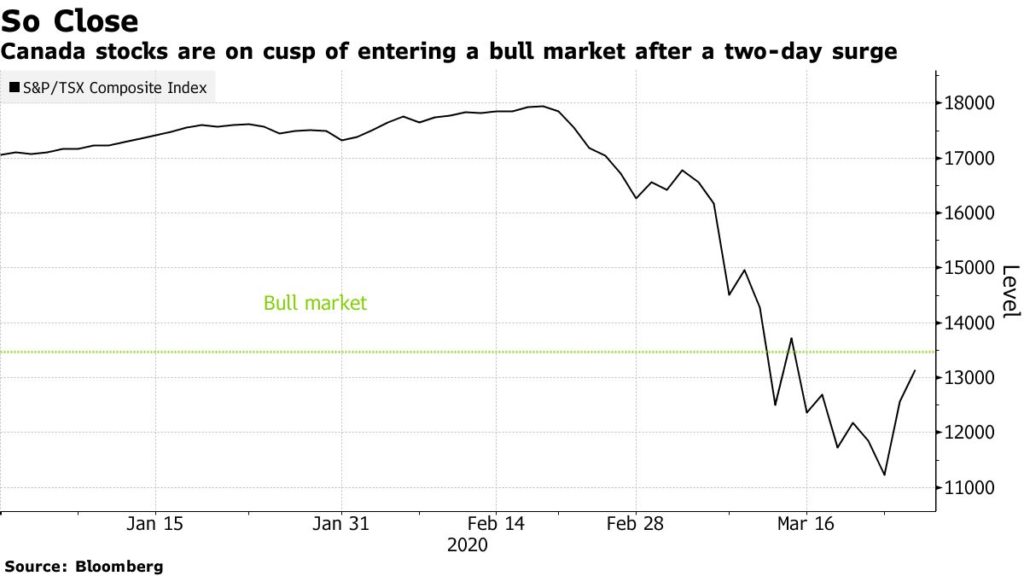

As a result, we are beginning to see occasional huge moves to the upside in the midst of the selling frenzy. The TSX surged by a record 12% on March 24, a day after reaching its lowest level since 2011. An additional 4.5% gain on March 25 has now put it within 335 points or 2.5% away from crossing 13,474.19, which would be 20% above its March 23 closing low of 11,228.49, and hence signal a new bull market, as a Bloomberg article (2) rather optimistically suggests (Figure 1).

We doubt the bull market is within reach just yet. Among other things, some of the biggest market advances have occurred in the midst of bear markets. For now, however, with the green shoots that are beginning to emerge in the markets offering some hope to long-term investors like us, we are using market volatility to add opportunistically to our core portfolio positions.

1 https://www.bloomberg.com/news/articles/2020-03-23/beyond-virus-count-here-s-the-signs-to-watch-for-market-rebound

2 https://www.bloomberg.com/news/articles/2020-03-25/canadian-stocks-whipsaw-as-traders-digest-stimulus-packages

Figure 1: TSX Composite: YTD 2020

________________________________________________________________________________

This information has been prepared by Robert Luft and Elvis Picardo, who are Portfolio Managers, and Aaron Arnold, who is an Investment Advisor, for HollisWealth® and does not necessarily reflect the opinion of HollisWealth®. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Robert Luft, Elvis Picardo and Aaron Arnold can open accounts only in the provinces in which they are registered. For more information about HollisWealth, please consult the official website at www.holliswealth.com. Luft Financial is a personal trade name of Robert Luft.