Investors looking past dismal data, murky earnings season, to normal times

After a month of social distancing and the virus-induced lockdown, the prospect of unfettered freedom to indulge in normal, everyday activities like dining out, shopping, travelling – and yes, even going to work – likely seems more alluring by the day to hundreds of millions around the world. The growing possibility that things will get back to some semblance of normalcy after a period of time (that is admittedly still undefined) has been a powerful motivator for investors to get back into the market.

Amid growing signs that the coronavirus outbreak is leveling off in the worst-affected regions and easing up in other places, the debate is now shifting from managing the deadly effects of the pandemic, to when and how the economy should reopen. As a result, investors and institutions are looking past dismal data and a murky earnings season to a resumption of normal economic activity. This is apparent even in the gloomy assessment of the International Monetary Fund (IMF) in its World Economic Outlook (WEO) report released on April 14.

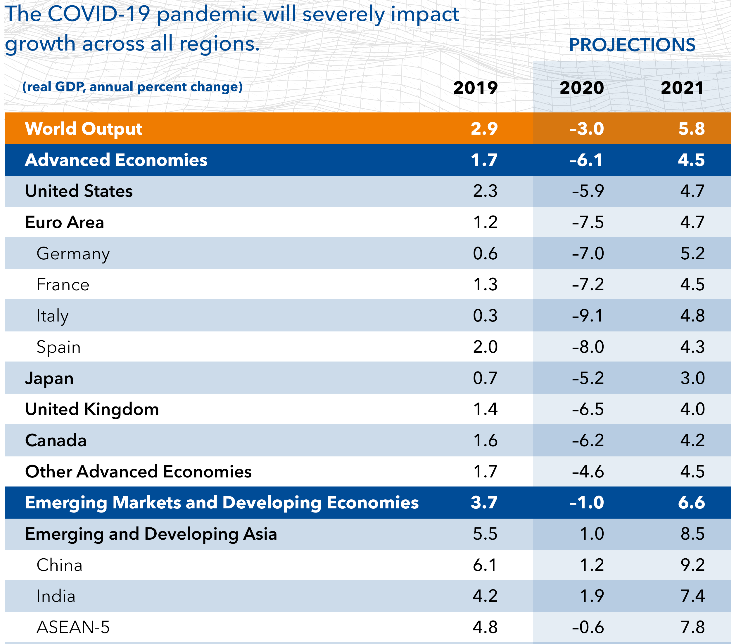

The IMF estimates that as a result of the “Great Lockdown”, the global economy will shrink by 3% in 2020, the steepest in almost a century and much worse than the mere 0.1% contraction during the 2008-09 financial crisis.

However, global growth is projected to rebound to 5.8% in 2021 (Fig.1) in the IMF’s baseline scenario, as policy support (such as fiscal stimulus and relief measures) enables the normalization of economic activity. The key assumption in this scenario is that the pandemic fades in the second half of 2020 and global containment efforts can be gradually unwound. The IMF admits that there is extreme uncertainty around its global growth forecasts because it depends on numerous factors that are hard to predict, and there are substantial risks for severe outcomes. But for now, investors are taking those downbeat projections in stride, judging by the average gain of 3.1% in the three major U.S. indices yesterday.

As for corporate earnings in Q1 of 2020, which companies will begin announcing shortly, it is hard to imagine another quarter when profits were impacted so swiftly and negatively, as consumer demand fell off a cliff and the global economy came to a virtual standstill. For what it’s worth, earnings aggregator FactSet reports that the estimated earnings change for S&P 500 companies in Q1 is -10% (i.e. down 10% from a year ago), but that may prove to be way off the mark. Given the huge amounts of uncertainties still swirling around, few companies have visibility into their profits for the rest of the year.

For now, however, markets seem to have discounted most of the bad news, with U.S. indices up about 30% and the TSX Composite up 28% from their March 23 lows. After the panic selling witnessed in March, the sustained gains of the last three weeks are a welcome development.

Figure 1: Global growth projections in IMF’s WEO latest report

Source: IMF World Economic Outlook April 2020 Report

_______________________________________________________________________________

This information has been prepared by Robert Luft and Elvis Picardo, who are Portfolio Managers, and Aaron Arnold, who is an Investment Advisor, for HollisWealth® and does not necessarily reflect the opinion of HollisWealth®. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Robert Luft, Elvis Picardo and Aaron Arnold can open accounts only in the provinces in which they are registered. For more information about HollisWealth, please consult the official website at www.holliswealth.com. Luft Financial is a personal trade name of Robert Luft