Summary

Market Review: Global indices staged a huge rebound in an exceptionally challenging month to pare most of their declines in April, with the TSX Composite and S&P 500 trimming a four-day plunge of more than 12% to finish marginally lower. The market rally has continued to pick up steam in the first three weeks of May, as the TSX Composite reached a new record high and the S&P 500 edged closer to the 6,000 level.

Outlook: Although this has been a stunning rebound, with the S&P 500 and Nasdaq Composite in technical bull markets after surging over 20% from their April lows, we believe a degree of caution is in order given the number of risks that are still out there.

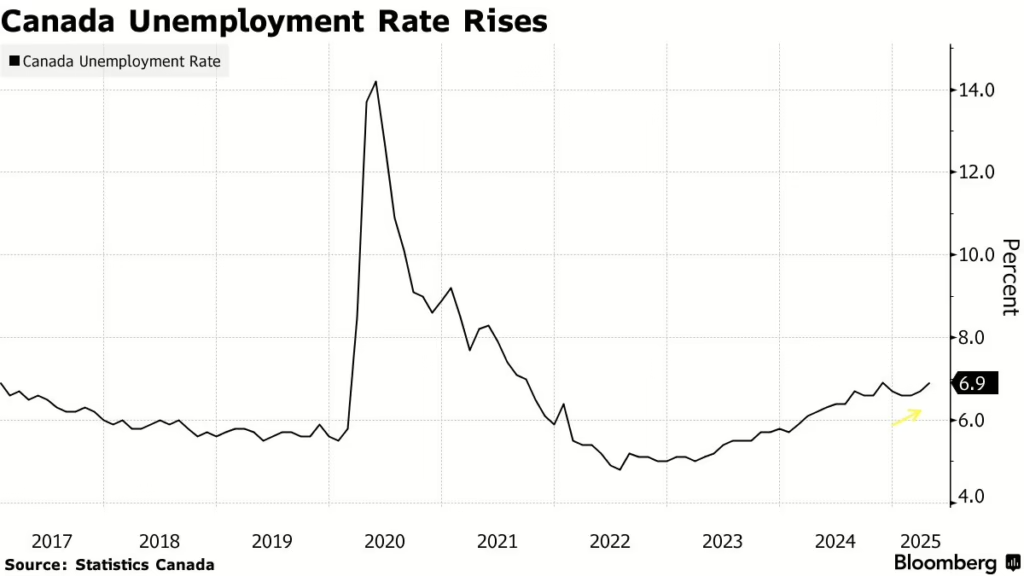

In Canada, while consumer sentiment has improved as the Federal election dissipated political uncertainty, the economic backdrop remains gloomy. Canada’s unemployment rate rose to an eight-year high (excluding the pandemic) of 6.9% in April, the third straight month where the Canadian economy registered either job losses or little change in employment, suggesting that trade uncertainty is having a detrimental impact on hiring plans. Canadian inflation eased in April to its slowest pace since September on the elimination of the consumer carbon tax and a decline in oil prices, but core measures of inflation accelerated. Traders have now halved the odds that the BoC will lower rates at its June 4 meeting, to a 35% probability, from nearly 70% previously.

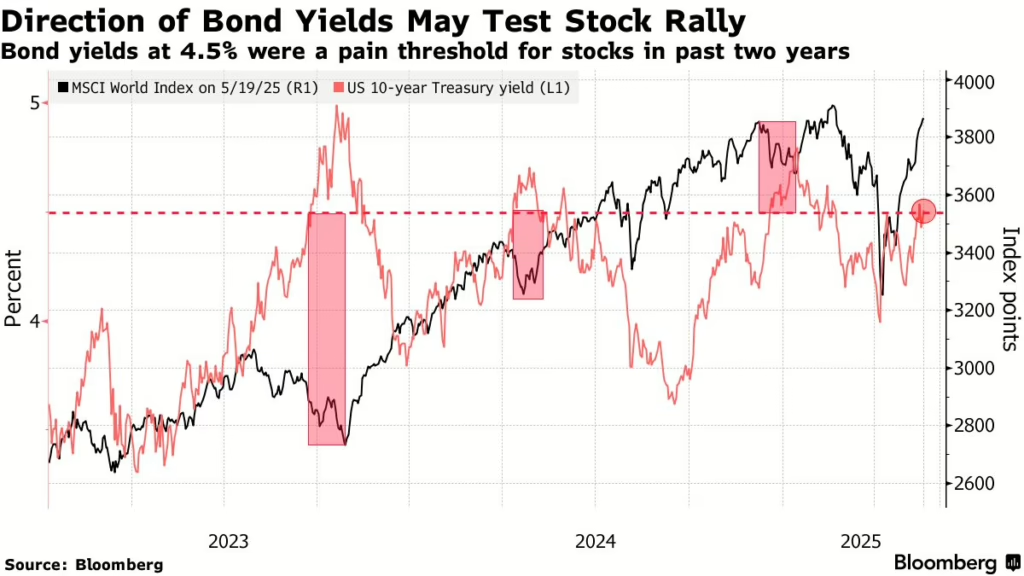

Despite economic headwinds, the TSX Composite has displayed resilience in the face of continued uncertainty, with the index trading at a record high of 26,053 on May 20, having surged 2,000 points or 8.33% in little over a month in a broad-based advance. Index earnings estimates have come down slightly but still reflect an optimistic outlook. Overall, although corporate earnings came in better than expected in Q1, numerous companies across the world are either withdrawing their forecasts for the year or providing downbeat guidance due to trade and tariff uncertainty. U.S. Treasury bond yields also bear watching, as the 16 basis points increase in 10-year and 30-year yields over the past month means that they are approaching levels that have triggered market pullbacks in recent months.

Portfolio Strategy: The Portfolio Management Team (PMT) continues to closely monitor market conditions and take steps to adjust portfolios in response. On April 30, we rebalanced all portfolios as we revised our target equity weight marginally lower to 59% (from 60%) in our Balanced Growth portfolios and concurrently made some adjustments to our geographic allocation. Earlier in April, we made some changes in our core Platinum Growth Fund, replacing two small-cap fund positions (based on sector volatility and a negative outlook) with a Europe-focused fund and a top-performing global technology fund.

The measures we have taken in recent months to fortify our portfolios and enhance diversification are working out well, with the PENSION Balanced Growth portfolio up 1.77% YTD (as of May 19, 2025). Our asset allocation remains neutral at the present time, but given the speed of the recent rebound, our next move is likely to be getting a touch more defensive if market conditions warrant such a move.

Market Review

Global indices staged a huge rebound in an exceptionally challenging month to pare most of their declines in April, with the TSX Composite and S&P 500 trimming a four-day plunge of more than 12% to finish marginally lower. President Trump’s April 2 rollout of the highest tariffs in over a century triggered a 11% slide in the S&P 500 over the next two days, before his April 9 announcement of a 90-day moratorium on tariffs led to the biggest surge in equity indices in years. The market rally has continued to pick up steam in the first three weeks of May, as the TSX Composite reached a new record high and the S&P 500 edged closer to the 6,000 level.

The TSX Composite finished the month of April 0.30% lower, as gains by defensive groups including consumer staples and utilities offset declines by the energy and communication service sectors. In the U.S., indices were slightly lower in April, after posting their biggest monthly decline since 2022 in March. The S&P 500 rebounded from the brink of a bear market to finish the month down by 0.76%. This was a remarkable recovery considering that the index had nosedived 21% over a seven-week period starting February 19, when it traded at a record 6,147. The Dow Jones Industrial Average slid 3.2% in April; the Nasdaq Composite finished up 0.85%, with its 12% surge on April 2 being its largest since 2001.

International indices were mixed in April, with European indices largely lower for the month. The Euro Stoxx 50 index lost 1.68% in April; as of May 19, it was up 10.85% for the year, outperforming the S&P 500’s 1.39% gain by 9.5 percentage points. Asian indices were mixed, with Japan and India finishing higher while Hong Kong, China and Taiwan were lower.

Overall, the MSCI AC World Index fell 0.52% in April after a 4.69% tumble in March. The global rally so far in May has enabled the index to gain 5.9% this month, taking it into positive territory for the year.

(Sources: FactSet, Bloomberg)

Outlook

Although this has been a stunning rebound, with the S&P 500 and Nasdaq Composite in technical bull markets after surging over 20% from their April lows, we believe a degree of caution is in order given the number of risks that are still out there.

In Canada, consumer sentiment has improved, as last month’s Federal election has dissipated the political uncertainty that had beset the economy since the beginning of the year. However, the economic backdrop remains gloomy, as evidenced by Canada’s unemployment rate rising to 6.9% in April, matching the highest levels in eight years excluding the pandemic (Figure 1).

Canada’s manufacturing sector lost 31,00 jobs, the biggest drop since January 2019 outside of the pandemic’s impact in 2020, as the impact of U.S. tariffs on export-oriented sectors such as automobiles and steel became more apparent. April was also the third straight month where the Canadian economy registered either job losses or little change in employment, suggesting that trade uncertainty is having a detrimental impact on hiring plans.

While the jobless data had traders speculating that the Bank of Canada (BoC) is likely to restart interest rate cuts in June, inflation data released on May 20 has led to a rethink. For context, the Bank of Canada (BoC) had announced a pause in its rate cutting cycle on April 16, leaving the policy rate at 2.75%, and said it would proceed carefully as it waits to see how President Trump’s trade policy takes shape.

Although Canadian inflation in April eased to its slowest pace since September on the elimination of the consumer carbon tax and a decline in oil prices, core measures of inflation accelerated, with the average of the BoC’s two preferred measures rising to a 3.2% annual pace, up from 2.9% in March. Traders have now halved the odds that the BoC will lower rates at its June 4 meeting, to a 35% probability, from nearly 70% previously.

Although Canadian inflation in April eased to its slowest pace since September on the elimination of the consumer carbon tax and a decline in oil prices, core measures of inflation accelerated, with the average of the BoC’s two preferred measures rising to a 3.2% annual pace, up from 2.9% in March. Traders have now halved the odds that the BoC will lower rates at its June 4 meeting, to a 35% probability, from nearly 70% previously.

Despite the Bank of Canada’s assessment in April that the Canadian economy is heading for a slowdown or a recession, the TSX Composite has displayed resilience in the face of continued uncertainty, with the index trading at a record high of 26,053 on May 20. The TSX Composite has surged 2,000 points or 8.33% in little over a month, powered by multiple sectors including financials, technology, consumer discretionary and industrials. Index earnings estimates have come down slightly, but still reflect an optimistic outlook, with EPS growth estimated at 8% this year (to $1,593) and almost 12% in 2026 (source: FactSet).

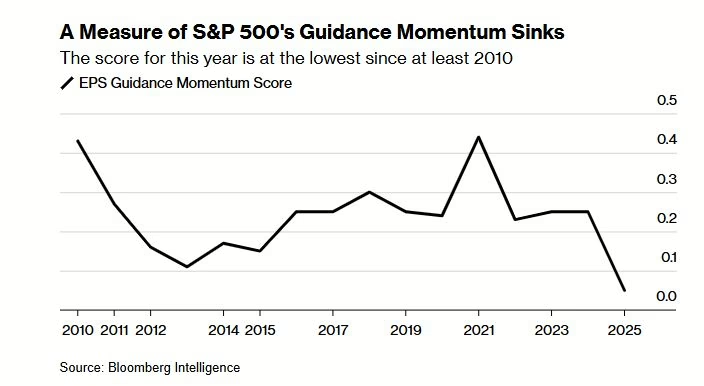

Overall, although corporate earnings came in better than expectations in Q1, numerous companies across the world are either withdrawing their forecasts for the year or providing downbeat guidance (Figure 2) on the back of rising costs, weak consumer sentiment and a lack of business confidence due to trade and tariff uncertainty. According to FactSet, the term “recession:” has been cited on 27% of 451 earnings calls conducted by S&P 500 companies since March 15, which is an unusually high number.

In the U.S., news that Moody’s Ratings had downgraded the US government’s sovereign credit rating by one notch (to Aa1 from Aaa) on May 16 was brushed aside by investors as risk appetite remained intact. However, U.S. Treasury bond yields bear watching, as the 16 basis points increase in 10-year and 30-year yields over the past month means that they are approaching levels that have triggered market pullbacks in recent months (Figure 3). As of May 20, the yield on the US 10-year Treasury is at 4.48%, and the 30-year Treasury yield is at 4.96%.

Portfolio Strategy

The Portfolio Management Team (PMT) continues to closely monitor market conditions and take steps to adjust portfolios in response.

On April 30, we rebalanced all portfolios as we revised our target equity weight marginally lower to 59% (from 60%) in our Balanced Growth portfolios. Concurrently, within our equity sleeve, we made some adjustments to our geographic allocation, taking advantage of the U.S. equity surge to take some profits and bring the weight down to 50% (from 55%), and increasing international equity to 20% (from 15%). Earlier in April, we made some changes in our core Platinum Growth Fund, replacing two small-cap fund positions (based on sector volatility and a negative outlook) with a Europe-focused fund and a top-performing global technology fund.

The measures we have taken in recent months to fortify our portfolios and enhance diversification are working out well, with the PENSION Balanced Growth portfolio up 1.77% YTD (as of May 19, 2025). Our asset allocation remains neutral at the present time, but given the speed of the recent rebound, our next move is likely to be getting a touch more defensive if market conditions warrant such a move.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.