Market Review

October was the sixth straight month of gains for global equities, although there was a noticeable uptick in volatility. The TSX Composite rose 0.8% last month, led by technology and utilities, while the materials sector was a notable detractor. The S&P 500 gained 2.3% in October, as the companies in the index collectively added $17 trillion from the April lows. The Dow Jones Industrial Average added 2.5%, and the Nasdaq Composite surged 4.7%. Most European and Asian indices gained last month, with Japan’s Nikkei index soaring 16.6% on optimism about its technology sector and prospects for fiscal stimulus.

The MSCI AC World Index gained 2.7% in October for a YTD gain of 17.3%.

(Sources: FactSet, Bloomberg)

Outlook

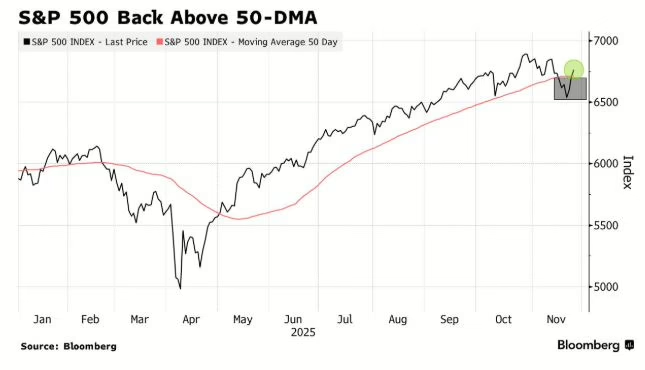

Notwithstanding the volatility seen earlier this month, sentiment appears to have improved heading into year end. Technology stocks have recovered after leading a pullback due to valuation concerns, while continued support from investors predisposed to buying the dips has pushed the S&P 500 back above the key 50-day moving average (Figure 1).

The rally is being propelled by optimism that Federal Reserve rate cuts will extend the market advance. Money markets are now pricing in an 80% chance of a Fed rate cut of a quarter-point in December, with three more cuts expected in 2026.

Expectations for continued robust earnings growth are underpinning the rally. According to FactSet, the S&P 500’s estimated earnings growth of 13.4% for the third quarter would be the fourth straight quarter of double-digit earnings growth. For full-year 2025, S&P 500 earnings are forecast to increase 12.2%, accelerating to 14.4% growth in 2026. Estimated earnings growth for the TSX Composite is on a similar trajectory, based on FactSet estimates, with earnings expected to increase about 12% this year and 14.8% in 2026.

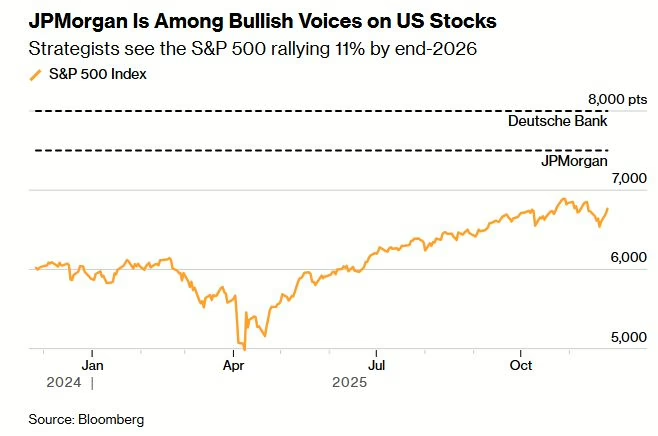

Bullish calls for 2026 are on the rise (Figure 2). Strategists at Deutsche Bank expect the S&P 500 to reach 8,000 by end-2026, supported by strong earnings and rising stock buybacks, while JP Morgan Chase has a 7,500 target. According to FactSet, the median target for the S&P 500 currently stands at 7,961, implying 17% upside from the present level of 6,812 (as of November 26). For the TSX Composite, which closed at a new high of 31,180 on November 26, the median target is 34,705, for potential upside of 11.3%.

Portfolio Strategy

Over the past four weeks, there is growing evidence of sector rotation in the U.S., away from mega-cap technology to other areas with better valuations like healthcare and financials. A broader rally, with participation from additional companies, could have a positive impact on markets and our portfolios because future gains would be supported by more stocks and not just a handful of the technology giants.

Our portfolio strategy continues to be focused on participating in market upside while mitigating downside risk. As part of this strategy, in the third quarter, we rebalanced all client portfolios to book gains in profitable positions and bring overall portfolio asset allocation back to target weights. We also added two fixed income alternatives to boost portfolio yield and provide a hedge against bond volatility.

We are investing new money in a measured manner, and for accounts that have periodic withdrawals, we have been raising 6 to 12 months of cash. We believe our portfolios are well positioned heading into year-end and will be looking to top up our equity allocation when we get an opportunity to do so.

To accompany this Portfolio Management Update, we’ve also posted our latest video, Inflection Point, and the Trade Update – Strategic Allocation: Capitalizing on the S&P 500 Pullback. If you haven’t viewed them yet, we recommend doing so, as together, all three provide a complete picture of recent market activity and the strategic adjustments we’re making to keep your portfolios balanced.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee their accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.