Three Rules to Survive Fall Markets

Market & Economic Environment:

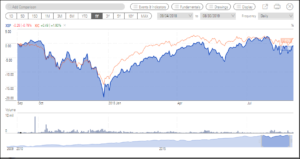

August saw XSP, the iShares S&P500 ETF that tracks the 500 largest US companies, in Canadian dollars, drop .89%.

In Canada XIC, the iShares TSX composite index tracking the Canadian stock market, was up .57%.

Year to date XIC is up 15.18% while XSP is up 15.72%. (source Morningstar Direct)

North American stocks, both in Canada and the US, have had a positive short-term run.

When looking back over one year, however, XSP is down .79%, and XIC up 1.9%.

The top 500 companies in the US market, in Canadian dollar terms, have not gained ground over the past 12 months, with Canada slightly positive.

And, equity markets experienced significant volatility over this time period. (see below)

Source: Morningstar Direct

Our Strategy:

With the start of September comes the return to school and regular work schedules for many people.

It can also be a time of heightened short-term volatility in equity markets, leading to additional stress.

Headlines continue to be dominated by trade talk woes, Brexit confusion, and interest rate movements.

The key to being a successful long-term investor in these periods is to remind yourself of some basics:

Here are three rules to help you.

Rule 1: What is the money for?

Always ask yourself this question first.

Is this short-term money or a long-term investment?

If you may need all of the capital back in the next one to three years, consider it as short-term money and keep it liquid, low risk, as cash. Call this your “emergency bucket”.

Rule 2: How much do I need to draw from this money, if at all?

This stems from rule 1.

If you don’t need the money in the short-term (up to three years) and you don’t need to draw from it, why are you worrying about the ups and downs over a one month, or even one year period?

If you do need to draw from it, consider what a reasonable withdrawal will be to make the money last (say through retirement). We generally recommend that taking 4-5% as an annual withdrawal from long-term portfolios is reasonable. If you need this money to last 20-25 years through retirement, then don’t concern yourself with short-term swings in the value over one month or one year periods.

Rule 3: How much volatility can you stomach in the short term?

Risk tolerance is all about your ability to sleep at night and not change your strategy during the short-term ups and downs.

Ask yourself: “what is the worst dollar change I could stomach prior to throwing my investment strategy out the window and reverting to cash.”

In other words, before I decide to move my long-term investment portfolio to short-term cash earning no return net of inflation.

Is this dollar change 10%? 20%? Zero? This will dictate your overall allocation to stocks, and thus the upside and downside potential of your portfolio. Most investors would be best suited to a portfolio similar to a large pension plan, (see CPP Investment Strategy, ) with 35% of the portfolio allocated to stable income producing investments like bonds, and the remaining 65% in shares of companies (stocks). This will generally give you 65% of the upside of the stock market over the long-term, and a bit smoother short-term experience if markets are turbulent.

If you have any questions or concerns, don’t hesitate to contact the team to discuss your personal situation.