SUMMARY – A Test of Resilience

Market Review: Global equities rallied for the fourth straight month in August to reach new highs, as investors continued to ignore growing risks that could set up an imminent test of market resilience. Interest rate cuts by the Federal Reserve and Bank of Canada on September 17 added more fuel to the rally, with major North American indices rising to new record highs the following day.

Outlook: With Q2 earnings largely coming in above expectations in Canada and the U.S., investors have seized upon interest rate cuts as the latest catalyst to push equities higher. As expected, the Bank of Canada cut the benchmark overnight rate by 25 basis points to 2.5%, the first rate cut since March. Most economists expect the BoC to slash its interest rate by an additional 25 basis points to 2.25% at its October meeting. Canadian households have so far proved to be quite resilient in the face of challenges posed by the slowing economy and rising unemployment. Unexpectedly strong results from Canada’s Big Six banks also confirm that the economy may be holding up better than expected.

In the U.S., the Federal Reserve cut its target range for the federal funds rate for the first time this year by 25 basis points to 4.00%– 4.25% and signaled two more rate cuts this year. Looking forward, economists are forecasting tepid U.S. economic growth and elevated inflation well into 2026, with GDP expected to grow 1.1% in the second half of 2025. Earnings estimates for the S&P 500 do not yet reflect the anticipated slowdown, with earnings-per-share (EPS) for the index forecast to increase 11% this year and 13% in 2026, to $266.48 and $302.23 respectively. On that basis, the index trades at a pricey earnings multiple of 22x estimated 2026 EPS.

Portfolio Strategy: As we have noted in previous reports, the growing disconnect between the economy and equities is making us increasingly cautious. Although the market rebound from the April low appears intact, the risks of a near-term market pullback are rising from a combination of slowing economic growth, tariff uncertainty, crowded positioning, and high valuations, in our opinion. While September’s typical market volatility has not surfaced so far, we believe there is a distinct possibility that the fourth quarter could be significantly more volatile than the third quarter has been. The Portfolio Management Team (PMT) will continue to make incremental changes to client portfolios to position them for changes in the markets and economy. Forthcoming portfolio changes include tweaks to the fixed income and alternatives sleeves, as we continue to fortify client portfolios to mitigate downside risk.

Market Review – Rebound continues with fourth month of gains

Global equities rallied for the fourth straight month in August to reach new highs, as investors continued to ignore growing risks that could set up an imminent test of market resilience. Interest rate cuts by the Federal Reserve and Bank of Canada on September 17 added more fuel to the rally, with major North American indices rising to new record highs the following day.

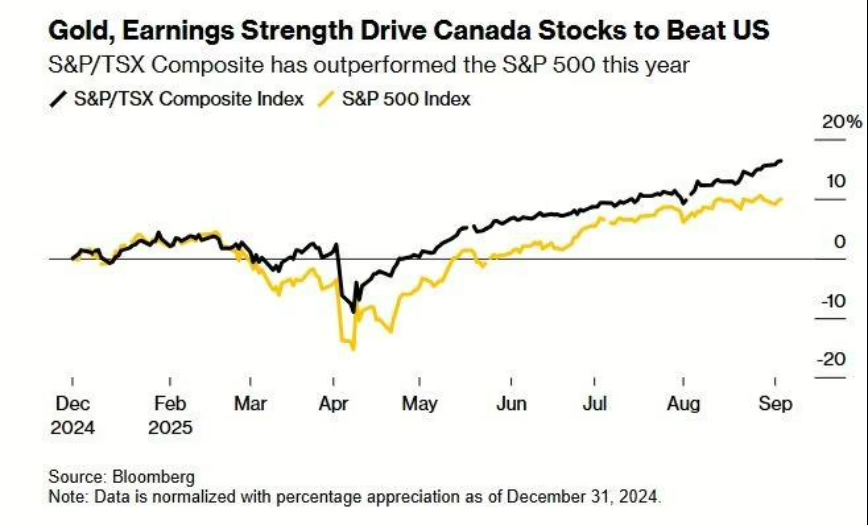

Canada: The TSX Composite surged 4.8% last month, led by the materials, health care and technology sectors, while defensive groups like consumer staples and utilities retreated marginally. The index has advanced 18.6% year-to-date (as of Sept. 17. 2025) in a broad advance led by a 60% surge in the materials group (with mining stocks up 69%) and double-digit gains in key sectors including financials, energy, and technology. The TSX is currently outperforming the S&P 500’s 12.2% YTD gain by 6.4 percentage points (Figure 1).

United States: U.S. indices continued their record run in August, with the S&P 500 gaining 1.9% as it rose past 6,500 for the first time, while the Dow Jones Industrial Average was up 3.2% and the Nasdaq Composite added 1.6%. The small-cap Russell 2000 index surged 7.0% in the month, beating the large-cap Russell 1000’s 2.0% gain by a whopping five percentage points.

International: The Euro Stoxx 50 index rose 0.6% last month for a YTD gain (as of August 31) of 9.3%, lagging the S&P 500 by 0.5 percentage point, a huge reversal after beating it by over 16 percentage points (in USD terms) in Q1. Other major European indices were mixed, while Asian indices were broadly higher, led by the Shanghai Composite’s 8% surge and the Nikkei index’s 4% advance. Overall, the MSCI AC World Index gained 1.9% in August for a YTD gain of 12.9% (as of Sept. 17, 2025). (Sources: FactSet, Bloomberg)

Outlook – Rate cuts are the latest catalyst

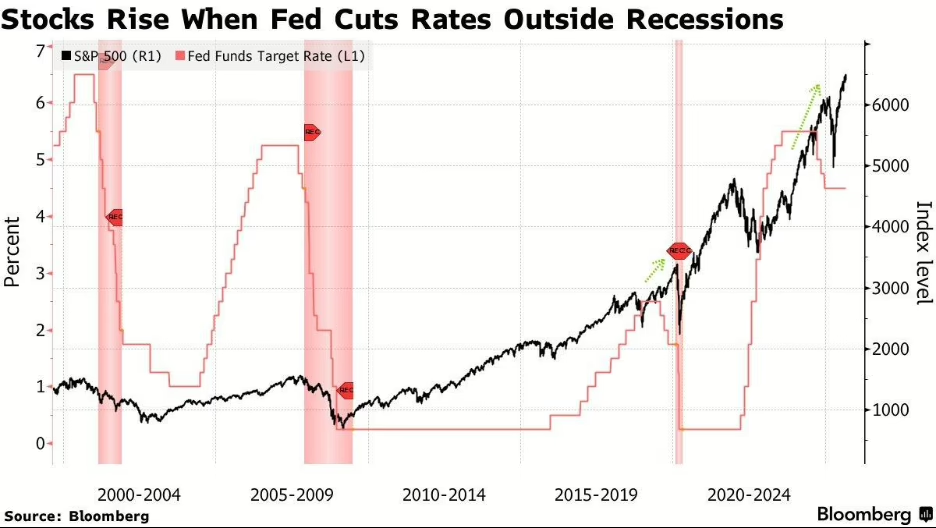

With Q2 earnings largely coming in above expectations in Canada and the U.S., investors have seized upon interest rate cuts as the latest catalyst to push equities higher (Figure 2).

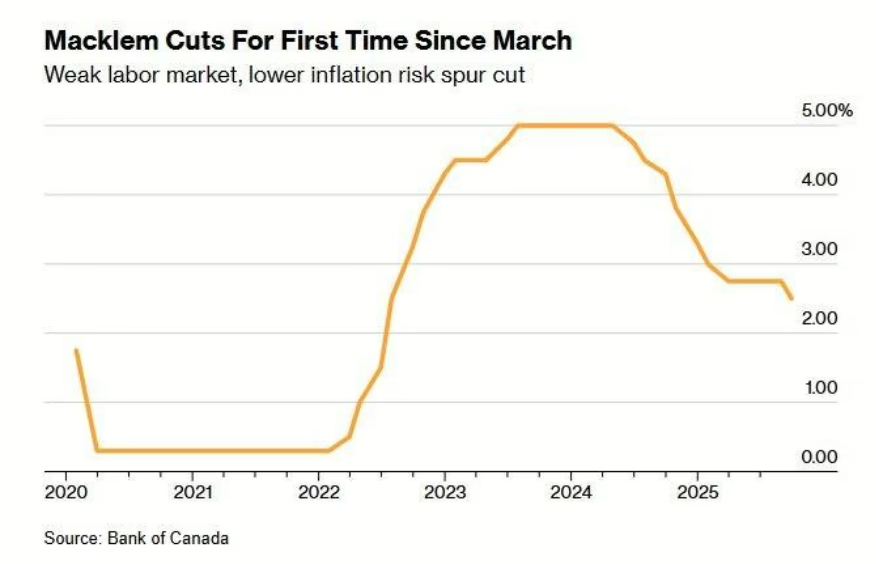

Investors’ expectations for rate cuts were high coming into the Bank of Canada’s (BoC) policy announcement on September 17, given the toll taken by tariffs on exports and economic growth. The Canadian economy contracted at a 1.6% annualized pace in Q2 (Figure 3), with the economy shedding 106,000 jobs in July and August as the unemployment rate edged up to 7.1%.

As expected, the BoC cut the benchmark overnight rate by 25 basis points to 2.5%, the first rate cut since March (Figure 4). While governor Tiff Macklem said the BoC does not expect a recession, bank officials expect ongoing trade tensions will continue to add to costs and weigh on economic activity. With underlying inflation at around 2.5%, the BoC noted that the federal government’s recent decision to remove most retaliatory tariffs on U.S. imports will mean less upward pressure on prices for these goods in the months ahead. Most economists expect the BoC to slash its interest rate by an additional 25 basis points to 2.25% at its October meeting.

Canadian households have so far proved to be quite resilient in the face of challenges posed by the slowing economy and rising unemployment, as household consumption rose 4.5% in Q2 despite slowing population growth. That resilience could be tested in the months ahead, since disposable income increased by just 1.3% in Q2, the weakest growth in over two years. In addition, although a Statistics Canada survey revealed that many Canadian companies are not yet passing on higher costs from tariffs to their customers – thus keeping inflation in check – about 40% of firms said it’s very likely or somewhat likely that they would need to increase prices to cover tariff costs over the next year.

Unexpectedly strong results from Canada’s Big Six banks confirm that the economy may be holding up better than expected. Five of the six banks exceeded earnings estimates – with net income for the group up 13.9% from a year ago – as they reported strength in their core businesses and set aside fewer provisions for bad loans. The Big Six have a significant influence on the fortunes of the TSX, as they collectively account for 20.8% of the index, while the financials sector overall comprises 32.5% of the index.

In the U.S., the Federal Reserve cut its target range for the federal funds rate for the first time this year by 25 basis points to 4.00% – 4.25% and signaled two more rate cuts this year. Despite concerns over tariff-driven inflation, the Fed cited growing signs of weakness in the labour market (Figure 5) as justification or the rate cut. In cutting the benchmark rate by only 25 basis points, Fed chairman Powell bucked months of pressure from the White House for lower borrowing costs, which had some market participants speculating that the Fed would cut by 50 basis points, as it did a year ago.

Looking forward, economists are forecasting tepid U.S. economic growth and elevated inflation well into 2026, with GDP expected to grow 1.1% in the second half of 2025. Earnings estimates for the S&P 500 do not yet reflect the anticipated slowdown, with earnings-per-share (EPS) for the index forecast to increase 11% this year and 13% in 2026, to $266.48 and $302.23 respectively (Source: FactSet). On that basis, the index trades at a pricey earnings multiple of 22x estimated 2026 EPS.

Portfolio Strategy

As we have noted in previous reports, the growing disconnect between the economy and equities is making us increasingly cautious. Although the market rebound from the April low appears intact, the risks of a near-term market pullback are rising from a combination of slowing economic growth, tariff uncertainty, crowded positioning, and high valuations, in our opinion. While September’s typical market volatility has not surfaced so far, we believe there is a distinct possibility that the fourth quarter could be significantly more volatile than the third quarter has been.

We continue to view the outlook for fixed income as being more attractive than it is for equities, based on an environment where growth is slowing appreciably and additional interest rate cuts are on the horizon.

The Portfolio Management Team (PMT) will continue to make incremental changes to client portfolios to position them for changes in the markets and economy. Forthcoming portfolio changes include tweaks to the fixed income and alternatives sleeves, as we continue to fortify client portfolios to mitigate downside risk.

To accompany this Portfolio Management Update, we’ve posted our latest video, A Test Of Resilience. In this video, Elvis Picardo breaks down the latest market trends, offers insights into the Canadian and U.S. economic outlook, and presents a detailed portfolio performance and strategy update for our clients.

Watch the video: A Test Of Resilience

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee their accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.