April 2024 Portfolio Management Team Update

April 2024 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth

April 10, 2024

Market Review

Global equities advanced for the fifth straight month in March, capping a stellar quarter for stocks and enabling the MSCI All-Country World Index to post a record high on the last trading day of the month.

The TSX Composite rose 3.8% last month to close just shy of its all-time high. Gains were led by the materials sector as gold hit a new high and metal prices rose, while higher crude oil prices due to growing geopolitical tensions boosted the energy group. The index advanced 5.8% overall in Q1; double-digit gains in the energy, industrial and health care groups, combined with solid gains in other sectors, offset a 10% plunge in telecoms and a 2% drop in the interest rate-sensitive utilities sector.

U.S. equity indices marched to new highs throughout the quarter. The S&P 500 reached new highs on 22 days as it notched its second successive double-digit quarterly gain, which according to Bloomberg data has only occurred on a handful of occasions since 1950.

The index gained 3.1% in March for a Q1 gain of 10.2%, after surging 11.2% in the previous quarter. The S&P 500’s advance was broad, with five sectors – communication services, energy, technology, financials, and industrials – registering double-digit gains in the quarter. The Dow Jones Industrial Average was up 2.1% last month and 5.6% in Q1; the Nasdaq Composite rose 1.8% in March and 9.1% for the quarter. Large-cap U.S. stocks continued to trounce small-caps in Q1, with the Russell 1000’s 9.9% surge almost twice the Russell 2000’s 4.8% gain.

With overseas markets also posting strong gains in March to cap an exceptional quarter, the MSCI AC World Index recorded its second consecutive quarterly advance of over 9%. Japan’s Nikkei 225 was the best performer among major markets in Q1 with a 20.6% surge thanks to robust earnings and investor-friendly measures. The Euro Stoxx 50 index rose 12.4% in Q1 with many European bourses also posting double-digit gains in the quarter. China’s CSI-300 index rose 3.1% in Q1 for its first quarterly gain after three successive declines. Hong Kong’s Hang Seng index was one of the few decliners in the first quarter with a 3% pullback. Taiwan’s benchmark index rose 7% in March and 13.2% in Q1 despite continued tensions with China.

(Sources: FactSet, Bloomberg)

Economic Outlook

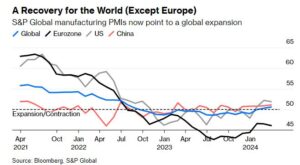

Recent economic data suggests that the global economy in general and the U.S. in particular are growing faster than earlier expectations. As a case in point, S&P Global’s purchasing manager indexes (PMI) – a reliable leading indicator of economic growth – show the global economy is back above the level of 50 that marks the division between expansion and contraction (Figure 1).

Figure 1: S&P Global PMIs suggest global expansion

In the U.S., the blowout jobs numbers reported on April 4 were the latest in a string of stronger-than-expected recent economic data. U.S. payrolls surged by over 300,000 in March, topping all estimates, while the unemployment rate edged lower to 3.8% and wages grew at a solid pace.

In contrast, the Canadian economy lost more than 2,000 jobs last month, the first job loss since July. The unemployment rate rose by 0.3 percentage points to 6.1%, the highest since January 2022 and the first time the jobless rate has risen above 6% since 2017 (excluding the Covid pandemic).

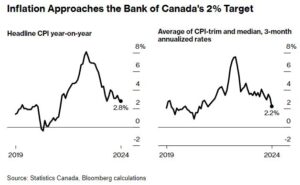

Nevertheless, the Bank of Canada (“BoC”) expects that economic growth will pick up this year – reflecting strong population growth and a recovery in household spending – after stalling in the second half of last year. On April 10, the BoC held its policy rate steady at 5% for the sixth consecutive meeting, signalling that it’s getting closer to rate cuts but still needs more evidence of slowing inflation. With inflation gradually approaching the BoC’s 2% target (Figure 2), Governor Tiff Macklem noted that a rate cut in June was within the ”realm of possibilities.”

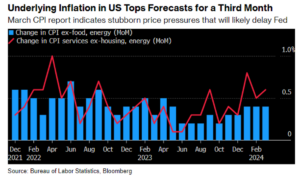

On the other hand, U. S. inflation continues to hold stubbornly high above 3%. The core consumer price index (CPI) exceeded forecasts for the third month in March (Figure 3), rising 0.4% from the previous month and up 3.8% year-over-year.

The data – released on April 10 – resulted in investors reassessing the prospects of rate cuts by the Federal Reserve to just twice this year, starting in September. Swap contracts anticipate the Fed’s benchmark rate will end the year only 40 basis points lower from the current 5.33% level. The inflation numbers also sent U.S. Treasury yields soaring to 2024 highs, with the two-year note yield up 23 basis points to 4.97%, and the 10-year note’s yield rising past 4.5% for the first time since November.

Figure 2: Inflation in Canada inches towards 2%

Figure 3: Higher for longer?

Portfolio Strategy

The U.S. stock market surge in Q1 occurred despite expectations for Fed rate cuts declining steadily over the course of the quarter, from the consensus view at the beginning of 2024 for six cuts commencing in March. However, the market pullback so far this month (as of April 10) suggests that this resilience may be fading, as concern grows that inflation may prove to be unexpectedly sticky. In addition, investors may finally be beginning to pay attention to escalating geopolitical tensions as the Middle East situation continues to worsen and the Russia-Ukraine conflict drags on.

Despite these concerns, the TSX Composite recently joined the long list of equity indexes hitting new highs, trading at a record of 22,380 on April 9. Although the index has finally broken out of the trading range that it was mired in for months, it remains to be seen whether it can hold on to its gains. Note that since the beginning of 2023, the TSX is up 14.5%, while the S&P 500 has surged 34.4% over this period, largely on account of the artificial intelligence (AI) boom.

In our opinion, the market is currently at an inflection point, with positives such as robust earnings growth and improving market breadth offset by sticky inflation and the prospect of a widening conflict in the Middle East. Volatility could well increase going forward, after remaining muted for months.

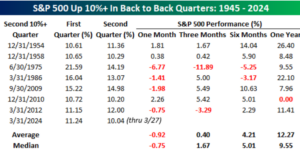

On an encouraging note, the S&P 500’s back-to-back quarterly gains bode well for future returns out to one year, judging by the historical record. According to Bespoke Investment Group, two straight quarters of 10%+ gains for the S&P 500 are followed by an average decline of almost 1% in the following month, but an average gain of 12.3% a year later (Figure 4).

The Portfolio Management Team (PMT) has had a busy quarter, deploying contributions made to registered and other accounts in a timely manner from January onwards, and rebalancing all client portfolios in the last week of February to increase equity allocation and implement a change in the equity alternatives sleeve of client portfolios.

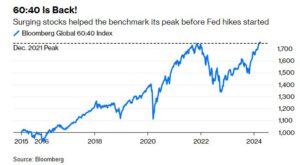

The PMT is comfortable with its current positioning, as overall equity allocation (in balanced growth portfolios) of around 60% will enable significant upside capture, while downside risk could be mitigated by long-duration fixed income, USD-denominated instruments, and alternative investments. Notwithstanding the recent backup in bond yields, we believe the 60-40 portfolio remains among the best investment choices for investors who don’t want to go too far out on the risk curve (Figure 5).

Figure 4: Back-to-back gains in S&P 500 signal more returns

Source: Bespoke Investment Group

Figure 5: The 60-40 portfolio is back in favour

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

June 2024 Portfolio Management Team Update

June 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth June 25, 2024 Market Review Global equities rebounded in May from the previous month’s decline that had interrupted five straight months of gains. While the TSX Composite reached an intra-day record high of 22,554.98 on May 21, continued […]

Read more

May 2024 Portfolio Management Team Update

May 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth May 17, 2024 Market Review Global equities fell in April after five straight months of gains, as concerns about sticky inflation and receding optimism about interest rate cuts by the Federal Reserve sapped investor sentiment. However, markets have […]

Read more

April 2024 Portfolio Management Team Update

April 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 10, 2024 Market Review Global equities advanced for the fifth straight month in March, capping a stellar quarter for stocks and enabling the MSCI All-Country World Index to post a record high on the last trading day […]

Read more