Bank of Canada raises rates: Should your mortgage be variable or fixed?

The spread in Canada between a five year fixed rate and a five year variable rate is currently at best 84 bps.

This is assuming Prime is now 3.7%. TD Prime-.9 on a variable=2.8% versus BMO five year fixed at 3.64%.

The odds of rates increasing over 84bps in the next 60 months are extremely high. Therefore, the variable rate product could be at a higher rate than the fixed rate product within only 24-30 months.

Why?

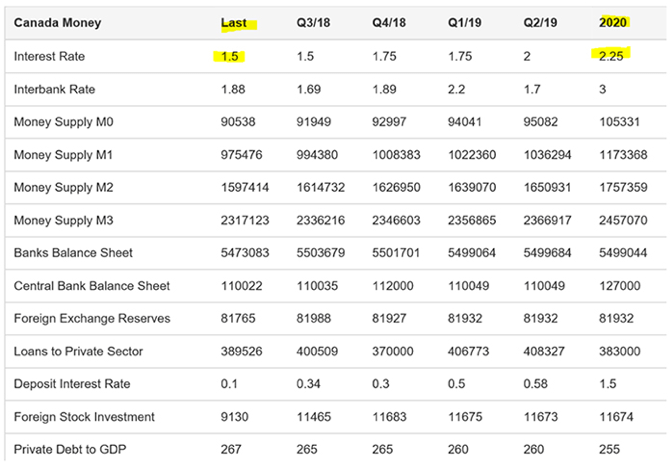

The Federal Reserve dot plot is assuming 7 more raises by the end of 2019: or 175bps with a target of 3 percent by 2020 from 1.5 now.

The Bank of Canada has raised 100bps since March 2017 alone.

Canadian interest rate policy decisions will be heavily influenced by other interest rates: i.e.: the federal reserve of the US, our largest trading partner.

Most expect Canadian rates to go up at least 75bps by 2020: two years.

Source: https://tradingeconomics.com/canada/interest-rate/forecast.

As the price of goods rises, especially in light of new tariffs, we will inadvertently import this US inflation, and Governor Stephen Poloz will have little choice, but to raise short term interest rates in Canada as well.

If not, he risks even more inflation for our importing consumers if the loonie plummets due to interest rate spreads between the two countries.

Source : https://www.cbc.ca/news/business/us-fed-interest-rates-canada-1.4567900

Contact us for more information.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

June 2024 Portfolio Management Team Update

June 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth June 25, 2024 Market Review Global equities rebounded in May from the previous month’s decline that had interrupted five straight months of gains. While the TSX Composite reached an intra-day record high of 22,554.98 on May 21, continued […]

Read more

May 2024 Portfolio Management Team Update

May 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth May 17, 2024 Market Review Global equities fell in April after five straight months of gains, as concerns about sticky inflation and receding optimism about interest rate cuts by the Federal Reserve sapped investor sentiment. However, markets have […]

Read more

April 2024 Portfolio Management Team Update

April 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 10, 2024 Market Review Global equities advanced for the fifth straight month in March, capping a stellar quarter for stocks and enabling the MSCI All-Country World Index to post a record high on the last trading day […]

Read more