Summary

Market Review: Global equity indices extended their extraordinary April rebound through the month of May, taking into stride persistent geopolitical risks, mixed economic data and evolving central bank policies. The TSX Composite reached successive new highs as investor sentiment remained resilient despite domestic economic headwinds, while the S&P 500 edged closer to the 6,000 level.

Outlook: The S&P 500 has surged almost 25% and the Nasdaq Composite has soared 32% from their April lows, propelled by Q1 earnings growth of 27.7% for the “Magnificent 7.” While the AI boom continues to drive technology stocks higher, the speed of the equity rebound amid growing risks warrants caution, in our opinion.

In Canada, despite an improvement in consumer sentiment after the April federal election, incoming data is distinctly soft as U.S. tariffs begin to bite. Despite risks to the economy, the Bank of Canada held its key interest rate at 2.75% for the second successive meeting on June 4, citing uncertainty from U.S. tariffs, elevated core inflation and a better-than-expected performance by the Canadian economy in Q1. The Bank noted that a rate cut may be necessary if the economy weakens and inflation remains contained.

In the U.S., job growth moderated in May and jobs numbers for previous months were revised lower. Inflation is moderating as well, with CPI up 0.1% from the previous month in May, while core inflation held at 2.8% for the third straight month, the slowest pace since spring of 2021. Although the inflation data had fuelled speculation about two rate cuts by year-end, the Federal Reserve has signaled an extended hold on interest rates in recent weeks.

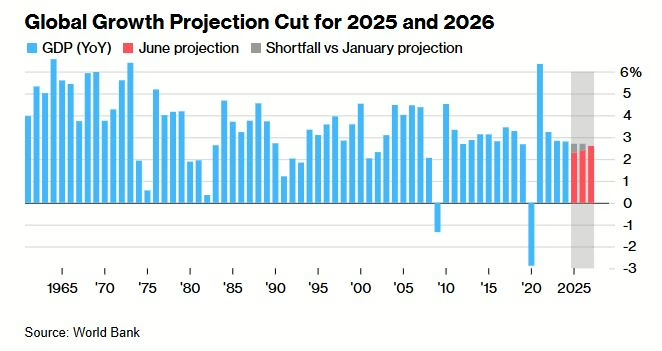

Given trade tensions and policy uncertainty, the World Bank last week cuts its forecast for global growth in 2025 to 2.3%, the weakest in 17 years. The World Bank also warned that global growth in the first seven years of this decade is on track to average 2.5% annually, the slowest for any decade since the 1960s.

Portfolio Strategy: The Portfolio Management Team (PMT) continues to closely monitor market conditions and is actively taking steps to adjust portfolios in response. In the first week of June, we took the opportunity presented by the broad market rebound to sell the AGF American Growth Fund (5% weight) in the Platinum Growth Fund (PGF) and trimmed the AGF Global Select Fund by 2% (to 10%). While both funds have been stellar performers in PGF, we made the changes due to the 53% overlap in holdings between the two funds, as well as to reduce the risk of manager concentration. Sale proceeds were used to invest in the CI Munro Global Growth Fund, effectively continuing to trim our U.S. exposure and increasing international holdings for better diversification.

With equity markets now back near all-time highs, prudent risk management assumes even greater importance. Although our asset allocation remains neutral at present, we may be inclined to book some profits in the near term, given the risk of a pullback in the volatile summer months.

Market Review

Global equity indices extended their extraordinary April rebound through the month of May, taking into stride persistent geopolitical risks, mixed economic data and evolving central bank policies. The TSX Composite reached successive new highs as investor sentiment remained resilient despite domestic economic headwinds, while the S&P 500 edged closer to the 6,000 level.

The TSX Composite gained 5.4% in May in a broad-based rally that saw all 11 sectors finish higher, led by the industrials, technology, consumer discretionary and financial sector. The S&P 500 advanced 6.2% as all sectors rose with the exception of health care. The Dow Jones Industrial Average recovered from its 3.2% slide in April to gain 3.9% last month, while the Nasdaq Composite surged 9.6%, its best monthly gain since November 2023.

International indices also rallied in May. The Euro Stoxx 50 index rose 4.0% as Germany and Italy led European indices higher. The Euro Stoxx 50 index continued to outperform the S&P 500 by more than 9 percentage points for the year as of May 31. Asian indices were mixed last month, with Japan, Taiwan and Hong Kong higher, while India and China posted marginal gains.

Overall, the MSCI AC World Index rose 5.4% in May, its best showing since November 2023, as risk appetite staged a broad recovery globally.

(Sources: FactSet, Bloomberg)

Economic Outlook

The S&P 500 has surged almost 25% and the Nasdaq Composite has soared 32% from their April lows, propelled by Q1 earnings growth of 27.7% for the “Magnificent 7,” which is actually slightly below their earnings growth rate of 32.1% over the previous three quarters. While the AI boom continues to drive technology stocks higher, the speed of the equity rebound amid growing risks warrants caution, in our opinion.

In Canada, despite an improvement in consumer sentiment after the April federal election, incoming data is distinctly soft as U.S. tariffs begin to bite. The economy added just 8,800 jobs in May, the fourth straight month of very little employment gains or outright job losses. Since February, the Canadian labour market has shed net 15,300 jobs as firms slow down hiring or lay off workers due to U.S. tariffs on multiple sectors. The unemployment rate rose in May for the third straight month to 7%, the highest level since September 2016 excluding the pandemic.

With U.S. demand plummeting due to the tariffs, data released earlier this month showed that Canadian exports to the U.S. plunged 15.7% in April. Total exports fell 10.8% in April, the largest percentage drop since December 2008, while Canada’s merchandise trade deficit widened to a record $7.1 billion.

Despite risks to the economy, the Bank of Canada held its key interest rate at 2.75% for the second successive meeting on June 4, citing uncertainty from U.S. tariffs, elevated core inflation and a better-than-expected performance by the Canadian economy in Q1. The Bank noted that a rate cut may be necessary if the economy weakens and inflation remains contained.

In the U.S., job growth moderated in May and jobs numbers for previous months were revised lower, suggesting employers are cautious about growth prospects. Inflation is moderating as well, with CPI up 0.1% from the previous month in May, while core inflation held at 2.8% for the third straight month, the slowest pace since the inflation surge in the spring of 2021. Although the inflation data had fuelled speculation about two rate cuts by year-end, the Federal Reserve has signaled an extended hold on interest rates in recent weeks.

Given trade tensions and policy uncertainty, the World Bank last week cuts its forecast for global growth in 2025 to 2.3% (Figure 1), the weakest in 17 years, excluding the recessions in 2009 and 2020 caused by the financial crisis and pandemic respectively. The World Bank also warned that global growth in the first seven years of this decade is on track to average 2.5% annually, the slowest for any decade since the 1960s.

Portfolio Strategy

The Portfolio Management Team (PMT) continues to closely monitor market conditions and is actively taking steps to adjust portfolios in response.

In the first week of June, we took the opportunity presented by the broad market rebound to sell the AGF American Growth Fund (5% weight) in the Platinum Growth Fund (PGF) and trimmed the AGF Global Select Fund by 2% (to 10%). While both funds have been stellar performers in PGF, we made the changes due to the 53% overlap in holdings between the two funds, as well as to reduce the risk of manager concentration. Sale proceeds were used to invest in the CI Munro Global Growth Fund, effectively continuing to trim our U.S. exposure and increasing international holdings for better diversification.

As mentioned in last month’s update, we rebalanced all portfolios on April 30 as we revised our target equity weight marginally lower to 59% (from 60%) in our Balanced Growth portfolios. Concurrently, within our equity sleeve, we made some adjustments to our geographic allocation, taking advantage of the U.S. equity surge to take some profits and bring the weight down to 50% (from 55%), and increasing international equity to 20% (from 15%). Other changes made earlier in April in the Platinum Growth Fund, wherein we replaced two small-cap fund positions with a Europe-focused fund and a top-performing global technology fund, have also boosted diversification.

The active measures we have taken in recent months to fortify our portfolios and enhance diversification are working out well. With equity markets now back near all-time highs, prudent risk management assumes even greater importance. Although our asset allocation remains neutral at present, we may be inclined to book some profits in the near term, given the risk of a pullback in the volatile summer months.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.