MACROSCOPE: Panic Doesn’t Pay – a lesson to heed on the 11th anniversary of the bull market

(This article was written on March 9, 2020; all market data is as of close on that date).

Spring may be around the corner, but in the financial markets, it feels like a long, hard winter is setting in.

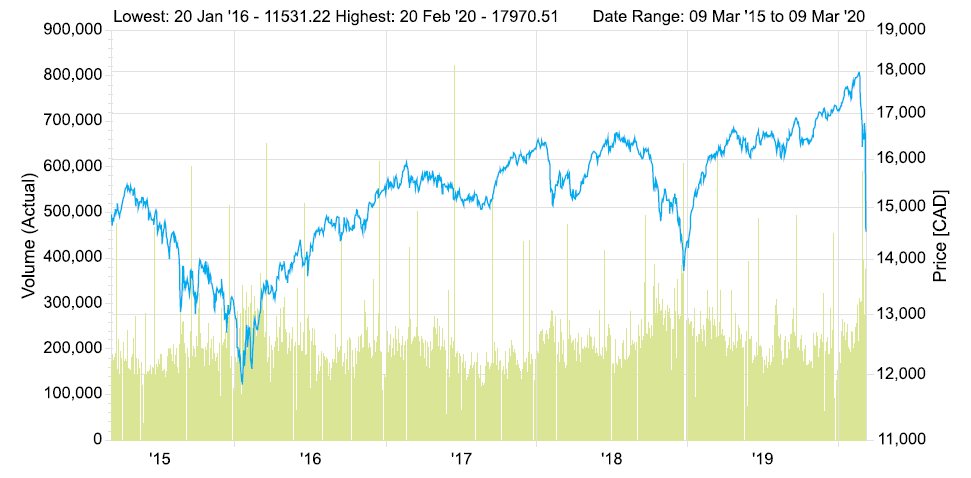

The third week of the global market selloff commenced with a plunge for the record books, as the TSX Composite plummeted by 1,660 points or 10.3% for its biggest one-day decline since 1987. In the U.S., the Dow Jones Industrial Average fell more than 2,000 points (its biggest point decline in history) or 7.8%, while the S&P 500 and Nasdaq Composite also tumbled over 7%. This was the worst one-day performance for U.S. indices since December 2008, when the global economy was in the throes of the financial crisis.

Today’s market rout was sparked by a 25% nosedive in the price of crude oil – triggered by the prospect of an all-out price war between Saudi Arabia and Russia – as well as intensifying concerns about the seemingly inexorable spread of the coronavirus worldwide.

As a result of today’s declines, the TSX Composite and the S&P 500, DJIA and Nasdaq Composite are all trading about 19% away from their record highs that were set a little over two weeks ago. This means that we are currently perilously close to the 20% pullback level that would mark an official bear market.

The speed of this correction is certainly unprecedented. A Bloomberg article notes that if the S&P 500 falls to 2,708.92 – which is 20% below its February 19 all-time closing high of 3,386.15 – before April 1, it would mark the fastest slump into a bear market from a record high. It would also mark the end of the bull market that coincidentally began exactly 11 years ago, on March 9, 2009.

Why did the bull market unravel so rapidly, in the span of less than three weeks? Here are some reasons, in our opinion:

- Investors were caught totally off-guard by the spread of the coronavirus – which is now seen as the ultimate “Black Swan” event – and the threat it poses to the global economy, leading to large-scale asset repricing at a pace seldom seen before.

- The proliferation of algorithmic and program trading may have exacerbated downward moves in the stock markets, as major indices have hurtled through one support level after the other.

- Misinformation and rumors about the coronavirus are running rampant to such an extent on social media that the World Health Organization calls it an “Infodemic.” 24/7 media coverage and the lightning-fast transmission of (mis)information in the age of Twitter and Instagram has undoubtedly contributed to panic-buying and heightened anxiety levels in the general public.

- There has been a dismal lack of leadership in some major nations, characterized by slow and inadequate responses to a mounting public-health crisis, as the global pandemic takes hold.

So, what should you do now?

The main lesson to be heeded on the 11th anniversary of the bull market is that “Panic doesn’t Pay.” Think back to March 9, 2009 and the doom-and-gloom that was prevalent then. Most global indices had plunged about 50% in the preceding 15 months, the global economy was mired in its worst financial crisis and deepest recession since the Great Depression of the 1930s, and trillions of dollars of household wealth had been wiped out.

Investors who sold their holdings at those lows and never ventured back into the markets subsequently missed out on a record U.S. rally that took the S&P 500 up 400% from its lows, and the TSX Composite up a more sedate 140% at its peak.

In our client portfolios, as noted in our previous Macroscope, we have taken steps over the past three months to reduce risk by improving portfolio quality, taking profits in some positions and adding to our fixed-income holdings. Last week, with equity indices down by 10%, we accumulated or added to positions in some of the world-class companies that are part of our equity portfolios. We anticipate continuing our portfolio rebalances if markets trend even lower. Given our long-term investment horizon, a 20% discount for stocks compared to their prices less than three weeks ago strikes us as a good deal.

Figure 1: TSX Composite’s biggest one-day plunge since 1987

Source: FactSet

________________________________________________________________________________

This information has been prepared by Robert Luft and Elvis Picardo, who are Portfolio Managers, and Aaron Arnold, who is an Investment Advisor, for HollisWealth® and does not necessarily reflect the opinion of HollisWealth®. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Robert Luft, Elvis Picardo and Aaron Arnold can open accounts only in the provinces in which they are registered. For more information about HollisWealth, please consult the official website at www.holliswealth.com. Luft Financial is a personal trade name of Robert Luft.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

June 2024 Portfolio Management Team Update

June 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth June 25, 2024 Market Review Global equities rebounded in May from the previous month’s decline that had interrupted five straight months of gains. While the TSX Composite reached an intra-day record high of 22,554.98 on May 21, continued […]

Read more

May 2024 Portfolio Management Team Update

May 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth May 17, 2024 Market Review Global equities fell in April after five straight months of gains, as concerns about sticky inflation and receding optimism about interest rate cuts by the Federal Reserve sapped investor sentiment. However, markets have […]

Read more

April 2024 Portfolio Management Team Update

April 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 10, 2024 Market Review Global equities advanced for the fifth straight month in March, capping a stellar quarter for stocks and enabling the MSCI All-Country World Index to post a record high on the last trading day […]

Read more