March 2023 Portfolio Management Team Update

March 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

March 23, 2023

Market Review

Global equities declined in February, paring part of January’s stellar gains, as stronger-than-expected economic data fueled concern that major central banks were not yet done with monetary tightening, sparking a broad selloff across asset classes.

The TSX Composite fell 2.6% in February, as most sectors declined, with only the consumer staples and industrial groups posting modest gains. Index declines were led by the materials group, as many gold and silver producers recorded double-digit drops, with energy and technology the other notable lagging sectors.

In the U.S., the S&P 500 also retreated 2.6% in February, while the Dow Jones Industrial Average slumped 4.2%. The Nasdaq Composite gave back 1.1%, after the 10.7% January surge that was its best start to a year in over two decades. Most European indices added to their gains, with the Euro Stoxx 50 index up 1.8% after a 9.8% surge in January. The MSCI Emerging Markets index tumbled 4.7%, led by a 7.5% plunge in Brazil’s Bovespa index. Overall, Hong Kong’s Hang Seng index was among the worst global performers with a 9.4% decline.

(Data Source: FactSet).

Our Strategy

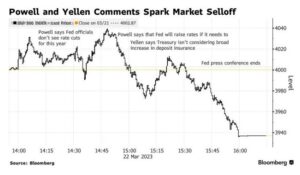

Since the S&P 500 and TSX Composite bottomed at just below 3,500 and 18,000 respectively in mid-October, the bull and bear camps have been engaged in a titanic struggle for ascendancy that intensifies with every interest rate announcement by the Federal Reserve. Market action following the Fed’s 25 basis-point hike on March 22 provides a classic example of this tussle (see Figure below).

The S&P 500 initially rallied on March 22 as the Fed’s rate increase was in line with expectations, but then sold off on Fed chair Powell’s comments that he was prepared to keep tightening until inflation shows signs of cooling. In addition, bank shares led the S&P 500 lower on Treasury Secretary Janet Yellen’s testimony to lawmakers that the government is not considering providing “blanket” deposit insurance coverage to stabilize the banking system.

The past month has seen the greatest resurgence of concern about the global financial system since 2008, after the back-to-back collapses of Silicon Valley Bank and Signature Bank, the second- and third-biggest U.S. bank failures in history. Despite concern that the failure of these regional banks may be a harbinger of a widespread financial crisis similar to the 2008 one, most experts believe that the damage will be limited this time. Since the financial crisis of 2008, regulatory reforms and greater oversight have resulted in most large banks having stronger balance sheets and lower exposure to risky assets. In Canada, the Big Six banks have well-diversified businesses, liquidity coverage ratios that exceed the regulatory requirement of 100%, and excellent risk management mandated by the stringent regulatory framework.

Against this backdrop of elevated risk in the financial system, the March 8 decision by the Bank of Canada (BoC) to hold its benchmark interest rate steady at 4.5% looks prescient. While the BoC became the first major central bank to halt monetary policy tightening, its diverging trajectory with the Federal Reserve has resulted in the Canadian dollar trading at 73 US cents presently, compared with 80 US cents a year ago.

Earlier this month, the yield on the two-year Government of Canada bond fell by 77 basis points in a three-day period, the fastest such decline since 1995, as traders price in rate cuts by the Bank of Canada later this year. 10-year government bond yields in Canada and the U.S. have also plunged over the past month, by 59 basis points (to 2.75%) and 48 basis points (to 3.40%) respectively.

Volatility in the equity and bond markets is giving us an opportunity to add to existing positions, based on our opinion that notwithstanding the occasional sharp pullback, equities may grind their way higher over the course of the year. The Portfolio Management Team (PMT) has been steadily deploying inflows from clients, including contributions to registered accounts, so far this year. While client portfolios continue to perform well as a result of the increased defensive tilt made late last year, the PMT expects to increase its growth allocation in the second half if the economic picture improves and inflation comes under control.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

June 2024 Portfolio Management Team Update

June 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth June 25, 2024 Market Review Global equities rebounded in May from the previous month’s decline that had interrupted five straight months of gains. While the TSX Composite reached an intra-day record high of 22,554.98 on May 21, continued […]

Read more

May 2024 Portfolio Management Team Update

May 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth May 17, 2024 Market Review Global equities fell in April after five straight months of gains, as concerns about sticky inflation and receding optimism about interest rate cuts by the Federal Reserve sapped investor sentiment. However, markets have […]

Read more

April 2024 Portfolio Management Team Update

April 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 10, 2024 Market Review Global equities advanced for the fifth straight month in March, capping a stellar quarter for stocks and enabling the MSCI All-Country World Index to post a record high on the last trading day […]

Read more