November 2023 Portfolio Management Team Update

November 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

November 23, 2023

Market Review

Global equities extended declines in October, falling for three straight months for the first time since the summer of 2022. However, the November 1 announcement by the Federal Reserve that it was holding off on raising interest rates – for the second successive meeting – has sparked a massive rebound so far this month on optimism that the central bank may now be finished with the most aggressive tightening cycle in four decades.

The TSX Composite fell 3.4% last month, closing below the 19,000 level and in the red for the year at -2.6%. 10 of the index’s 11 groups declined, led by health care, financials, technology, and real estate, with the consumer staples sector the only gainer in the month.

U.S. indices also declined in October, as the S&P 500 endured a three-month losing streak for the first time since the pandemic crash of 2020. The index fell 2.2% last month, while the Dow Jones Industrial Average was 1.4% lower and the Nasdaq Composite slid 2.8%. Large-cap US stocks continued to outperform small-caps, with the Russell 1000 down 2.5% in the month versus the Russell 2000’s 6.9% plunge. Major European and Asian equity indices also extended declines in October. (Source: FactSet)

The TSX Composite has staged a huge rally over the past month, gaining 7.6% (as of November 23) from its one-year low of 18,692 on October 27, 2023, with interest rate-sensitive sectors such as utilities and financials in the vanguard of the rally. The S&P 500 is up 11.0% from its five-month intra-day low on October 27, while a renewal of the AI hype has taken the Nasdaq 100 up almost 13% from its recent low to a 22-month high.

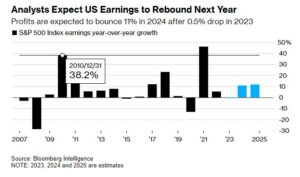

The ferocity of this rebound is reminiscent of the enormous rally in November 2020, when the announcement of successful trial results for Covid-19 vaccines led to record rotation into sectors that had been decimated by the effects of the pandemic. This time around, the rally is underpinned by implicit expectations of a “soft landing” for the U.S. economy on hopes that the steep rate hikes of the past 18 months will slow it down without tipping it into a severe recession. Analysts’ earnings estimate for the S&P 500 provide a measure of such optimism, with the index forecast to register double-digit earnings growth over the next two years, after likely posting a marginal decline in 2023 (Figure 1).

The earnings picture is similarly optimistic for the TSX, with earnings forecast to rebound 11% in 2024 after a steep 8% decline expected for this year. But it remains to be seen whether forward earnings estimates for the TSX are too rosy against a backdrop of a Canadian economy that is forecast by the Bank of Canada to grow only 0.9% next year, as consumers curtail spending due to rising debt payments and higher inflation. Canadian banks – which are a significant driver of the TSX – are set to report fourth-quarter earnings shortly, and their reports will provide additional clues on the state of the Canadian economy.

Figure 1: Forward earnings estimates for the S&P 500

Portfolio Strategy

In our previous update a month ago, we had noted that the indiscriminate nature of the selloff in interest rate-sensitive and defensive sectors such as utilities, communications services and health care presented a great opportunity to load up on blue chips with strong balance sheets and healthy dividends. This has indeed proved to be the case; expectations that interest rates may have peaked have resulted in yields retreating, with 10-year government bond yields down 30 basis points (to 3.7%) in Canada and down 45 bps (to 4.4%) in the U.S., which has in turn triggered a substantial rally in multiple sectors.

Many of the stocks in our large-model portfolios have outperformed their underlying indices and registered double-digit gains so far in November. Some of the biggest gainers MTD include Qualcomm (+17.0% for the month, as of Nov. 23), Disney (+16.5%), Brookfield Renewable Partners (+16.5%), Rogers Communications (+14.5%), Magna International (+11.7%), Salesforce (+11.5%), and Medtronic (+11.1%). The Platinum Growth Fund, which is held in all models at Luft Financial, has gained 7.5% for the month (as of Nov. 23).

Having completed its bi-annual asset allocation review earlier this month, the Portfolio Management Team (PMT) decided to leave its high-level allocation unchanged from the defensive posture that was adopted a year ago, based on the view that a recession in Canada is quite likely in 2024. In the equity sleeve, however, the PMT cut its allocation to Canadian equities and added the proceeds to U.S. ETFs, primarily to redress the underweight allocation to the mega-caps that have been driving U.S. indices.

Specifically, the PMT capitalized on the recent market surge to liquidate its positions in specific stocks that had either reached their profit targets (Hydro One, Qualcomm) or were no longer deemed as core holdings for client portfolios (Brookfield Renewable Partners, Pembina Pipeline, Unilever). The proceeds were allocated to two U.S.-focused ETFs – iShares Core S&P Index hedged ETF (XSP), and Fidelity US Value ETF (FCVH) – as well as the TD U.S. Quantitative Equity Fund. “Quant” funds adopt a rigorous, rules-based methodology that enables them to outperform significantly in volatile markets. In our dividend models, we exited some positions to harvest tax losses and allocated the proceeds to equivalent funds or ETFs, including two “quant” RBC ETFs.

On the fixed-income side, with interest rate cuts a distinct possibility in 2024, we are increasingly confident that our moves to increase duration will pay off. Last month, we swapped a corporate bond ETF for the TD Canadian Long Term Federal Bond ETF (TCLB), which has an overall duration of 14 years; this ETF has already gained 5.2% since we added it to client portfolios.

Market volatility has eased off, as we expected it would in our previous update, and November – generally one of the best months for market performance – has closely followed the seasonal trend that has been remarkably apparent since summer. December tends to be a mixed month, and this year should be no different, as profit-taking spurred by the strength of the November rally, and potential tax-loss selling, offset positive drivers such as decelerating inflation, expected earnings growth, and lower geopolitical risk (compared to a month ago). While several influential strategists expect the S&P 500 to hit a record high in 2024, that outcome is unlikely for the TSX, in our view. The PMT believes that the recent changes to client portfolios, which have increased U.S. exposure at the expense of Canada, position them favorably going into 2024.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

June 2024 Portfolio Management Team Update

June 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth June 25, 2024 Market Review Global equities rebounded in May from the previous month’s decline that had interrupted five straight months of gains. While the TSX Composite reached an intra-day record high of 22,554.98 on May 21, continued […]

Read more

May 2024 Portfolio Management Team Update

May 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth May 17, 2024 Market Review Global equities fell in April after five straight months of gains, as concerns about sticky inflation and receding optimism about interest rate cuts by the Federal Reserve sapped investor sentiment. However, markets have […]

Read more

April 2024 Portfolio Management Team Update

April 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 10, 2024 Market Review Global equities advanced for the fifth straight month in March, capping a stellar quarter for stocks and enabling the MSCI All-Country World Index to post a record high on the last trading day […]

Read more