October 2023 Portfolio Management Team Update

October 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

October 25, 2023

Market Review

September lived up to its reputation as the worst month of the year for stock markets, with global equities posting significant declines as rising bond yields fueled concern that interest rates would stay elevated well into 2024.

The TSX Composite fell 3.7% last month, taking the index into the red for the third quarter (Q3) at -3.1%. Energy was the only group to eke out a marginal 0.3% gain for the month. As many as six of the index’s 11 sectors plunged at least 6% in September, led by a 10% tumble in technology. Interest rate-sensitive sectors including utilities, real estate, and communication services, declined by 7% or more last month.

U.S. indices also declined across the board in September, taking them into negative territory for the third quarter. The S&P 500 fell 4.9% last month and was down 3.7% in Q3; the sector performance profile was like that of the TSX, with the energy group the only gainer in the month and six sectors recording a decline of at least 5%. The Dow Jones Industrial Average was 3.5% lower last month (-2.6% in Q3) while the Nasdaq Composite fell 5.8% (-4.1% in Q3).

The seven largest stocks in the U.S. (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) continue to dominate market performance stateside, with an average gain of over 80% YTD (as of October 25). This dominant performance has led to large cap stocks trouncing their smaller-cap peers so far in 2023; as of end-September, the Russell 1000 was +11.7% YTD, compared to +1.4% for the Russell 2000.

Most European and Asian equity indices also declined in September, contributing to negative performance in Q3. Japan’s Nikkei and the Euro Stoxx 50 index fell 4.0% and 5.1% respectively in the quarter to pare part of their gains for the year (Data Source: FactSet).

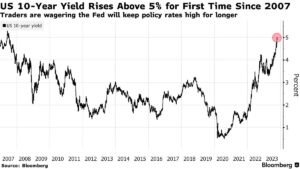

Global markets continue to be roiled by the surge in U.S. bond yields, with the 10-year Treasury yield exceeding 5% on October 23 for the first time since 2007 (Figure 1). The 10-year Treasury yield has increased more than four percentage points over the past three years, the biggest increase since the run up in yields in the early 1980s.

Bond yields have been rising this year as central banks remain resolute in their commitment to quell inflation by keeping interest rates “higher for longer.” On October 25, the Bank of Canada (BoC) kept its benchmark overnight lending rate unchanged at a 22-year high of 5% for the second straight meeting. Bank of Canada policymakers noted that despite slowing economic growth, additional rate hikes remain a possibility as inflation is expected to remain elevated at about 3% in 2024, up from a 2.5% forecast in July. On September 20, the U.S. Federal Reserve left its benchmark federal funds rate unchanged while signaling that more rate hikes are likely.

Figure 1: US 10-year Treasury yield at a 16-year high above 5%

Portfolio Strategy

Market sentiment has turned decidedly bearish from August onwards. The TSX initially fell almost 5% from an interim high around the 20,6000 level in the first three weeks of August, recouping its losses to trade at that level again on September 15, but then tumbling 8% this time around. As for the S&P 500, the recent upsurge in market volatility makes it hard to fathom that the index was less than 5% away from its all-time record as recently as three months ago. But after reaching a 16-month high of 4,607 on July 23, the S&P 500 has since slid 9%, while the Nasdaq Composite is down 11% over a similar timeframe.

The technical picture appears bearish, but that is to be expected against the backdrop of a looming slowdown that could morph into a recession – hopefully, a short and shallow one. According to the Bank of Canada’s projections released on October 25, growth estimates for 2023 were revised lower to 1.2% (from 1.8% earlier), with growth expected to slow to just 0.9% in 2024.

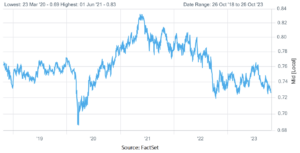

While Canadian consumers are feeling the pinch from soaring interest rates, U.S. consumer spending has held up well, contributing to resilience in broader U.S. economic growth. As a result, analysts predict that S&P 500 earnings will rebound 6.5% in the fourth quarter, after declining for four straight quarters (Figure 2).

Overall, S&P 500 earnings are forecast to grow only marginally this year before increasing 12% in 2024 to $245 per share. For the TSX, earnings are forecast to rebound 11% in 2024 to $1,584 per share, after falling 8% this year. The recent market decline has improved valuations significantly, with the S&P 500 now trading at about 17x 2024 EPS, and the TSX at 12x 2024 EPS.

Figure 2: U.S profit recession forecasted to end after four straight quarterly declines

While those earnings estimates likely discount a “soft landing” scenario in the U.S., key risks to that outlook include inflation staying stubbornly high, and spiraling geopolitical risk characterized by a dangerously volatile situation in the Middle East.

A notable feature of the recent selloff is its widespread nature, which has engulfed sectors that have traditionally been viewed as defensive, including utilities, communication services, consumer staples and health care. The term “defensive” implies that these sectors have more stable cash flows than cyclical sectors, since in a recessionary environment, consumers will prioritize paying for essentials (like utilities, groceries, and medications) over discretionary expenses.

These sectors have plunged over the past couple of months for differing reasons. Utilities are a low-growth sector that typically carry a substantial amount of debt; in a high interest-rate environment, utilities are constrained not just by rising interest expenses, but are also less attractive to investors as their rich dividends face competition from GICs and high interest rate savings accounts (HISAs).

The consumer staples and health care (specifically medical devices) sectors have been buffeted by a new development – the weight-loss drugs whirlwind referred to as the “Ozempic Effect.” An October 10 announcement by Ozempic maker Novo Nordisk that the drug proved surprisingly effective in treating kidney disease sparked a $3.6-billion selloff in dialysis providers. Ozempic’s effectiveness in helping people lose weight, combined with early evidence that it and similar drugs (known as GLP-1 receptor agonists) may have a protective effect on the heart, liver and kidneys, has led to optimism that they may be useful in treating cardiovascular disease – a $250-billion industry in the U.S. – sparking declines in manufacturers of pacemakers and cardiac devices. In addition, Ozempic’s ability to curb appetite and impulsive eating has triggered selloffs in grocery and fast-food chains.

The Portfolio Management Team (PMT) believes that the indiscriminate nature of the selloff in some of these sectors represents a great opportunity to load up on blue chips with strong balance sheets and healthy dividends. The potential for substantial capital appreciation from these “bond proxies” also exists if interest rates begin trending lower next year.

Based on the PMT’s view that the peak for interest rates may be approaching, the duration of the fixed income portfolio was increased this month by swapping a corporate bond ETF for an ETF that holds long-dated Canada bonds (overall duration of 14 years).

The PMT expects to incrementally increase its exposure to U.S. securities in its next full rebalance of client portfolios in November. In our large-model portfolios, the 20% or greater exposure to US dollar-denominated assets is providing a degree downside risk mitigation as the Canadian dollar weakens (Figure 3).

We expect current market volatility to ease off, and are optimistic that seasonal strength will kick in, as we head toward year-end. While solid earnings, valuation support and the possibility of slowing inflation are reasons for optimism, this is tempered by the troubling confluence of macroeconomic and geopolitical risk. We will reassess our asset allocation at our bi-annual exercise next month and expect to tweak it to be marginally less defensive as we head into 2024.

Figure 3: Canadian dollar trades at 7-month low after BoC announcement

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

June 2024 Portfolio Management Team Update

June 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth June 25, 2024 Market Review Global equities rebounded in May from the previous month’s decline that had interrupted five straight months of gains. While the TSX Composite reached an intra-day record high of 22,554.98 on May 21, continued […]

Read more

May 2024 Portfolio Management Team Update

May 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth May 17, 2024 Market Review Global equities fell in April after five straight months of gains, as concerns about sticky inflation and receding optimism about interest rate cuts by the Federal Reserve sapped investor sentiment. However, markets have […]

Read more

April 2024 Portfolio Management Team Update

April 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 10, 2024 Market Review Global equities advanced for the fifth straight month in March, capping a stellar quarter for stocks and enabling the MSCI All-Country World Index to post a record high on the last trading day […]

Read more