September 2022 Portfolio Management Team Update

September 2022 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

September 15, 2022

Market Review and Economic Environment

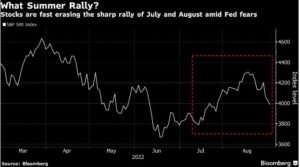

The summer rally that had enabled U.S. indices to claw back half their 2022 losses by mid-August came to a grinding halt in the second half of the month (Figure 1).

Investors were rattled by hawkish comments from major central banks seeking to dampen inflation that is at multi-decade highs. The selloff accelerated after Federal Reserve chairman Powell warned on August 26 that higher interest rates and slower growth would bring “some pain” to households and businesses.

The TSX Composite pared part of its 4.4% gain in July with a 1.8% decline in August that was led by the technology, real estate, and financial sectors. The S&P 500 and Dow Jones Industrial Average fell over 4%, while the Nasdaq Composite slumped 4.6%. European bourses fell across the board, with some indices down 5%, while major emerging markets such as Brazil and India bucked the downward trend to post gains (Data Source: FactSet).

Figure 1: Summer rally fades in the second half of August

Although the Federal Reserve had raised the federal funds rate on July 27 by 75 basis points for the second successive meeting, investors had interpreted Powell’s comments at that time as signaling a dovish tilt to monetary policy. The S&P 500 gained nearly 4% over the next couple of days for the biggest two-day gain on record following Fed tightening and was up almost 10% in a three-week period, before peaking just above 4,300 on August 16.

Powell’s stern warning at the conclusion of the Jackson Hole symposium on August 26 dispelled much of the optimism about a policy pivot by the Federal Reserve to a slower trajectory of interest rate increases. Subsequently, inflation data on September 13, which showed the U.S. consumer-price index rose 8.3% in August from a year ago, dashed any lingering hopes about monetary policy moderation in the near term.

Although the CPI figure was down from 8.5% in July and 9.1% in June – the highest inflation rate in four decades – it was higher than forecasts for an 8% increase. The data solidified expectations that the Federal Reserve would raise its benchmark by at least 75 basis points on September 21, triggering the biggest rout in U.S. indices since June 2020, with the S&P 500 tumbling 4.3% and the Nasdaq plunging 5.2%.

With inflation staying persistently high, central banks including the Bank of Canada and European Central Bank also ratcheted their benchmark interest rates by 75 basis points earlier this month. As a result, bond yields have surged over the past month, with the 10-year Government of Canada bond up by 42 basis points to 3.15%, and the U.S. 10-year Treasury yield up 59 basis points to 3.42%.

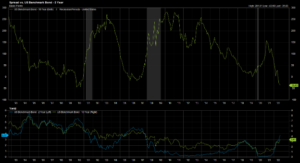

Yields on U.S. two-year Treasury notes – which reflect interest rate expectations – have soared even higher, by 360 basis points over the past year to a 15-year high of 3.79%. As a result, the spread between yields on 10-year and two-year Treasuries has widened to -37 basis points, the biggest gap since 2000 (Figure 2). This yield curve inversion is an ominous signal of an economic recession that could occur sometime in 2023.

Figure 2: 2-year/10-year Treasury yield curve most inverted since 2000 (Source: FactSet)

Our Strategy

Despite the grim news on the economic front, other developments offer glimmers of hope. On September 14, the World Health Organization said that “the world has never been in a better position to end the Covid-19 pandemic”, with the number of weekly reported deaths from Covid-19 the lowest since March 2020 and weekly case counts in all regions down 28% from a week ago. On the geopolitical front, Ukraine has recently recaptured 8,000 square kilometres of its territory from Russia.

Although it may be extremely premature to declare that either crisis is over, the end of the pandemic and/or the Russia-Ukraine war could alleviate some of the inflationary pressures that are besetting the global economy, by easing supply chain issues as well as food and energy shortages respectively.

Given this heightened degree of uncertainty, the Portfolio Management Team (PMT) is making changes to client portfolios in a measured manner. As the odds of a recession in North America have increased in recent months, the PMT is boosting the defensive tilt and overall quality of client portfolios.

In August, the PMT rebalanced portfolios with periodic cash withdrawals (such as RRIFs) to boost their cash holdings. In our larger Perennial portfolios, we sold Restaurant Brands International and used the proceeds to buy Medtronic, a global leader in medical devices. While the PMT believes client portfolios are presently well-positioned to withstand market turbulence, it intends to actively manage positions to capitalize on volatility in the fourth quarter.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

June 2024 Portfolio Management Team Update

June 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth June 25, 2024 Market Review Global equities rebounded in May from the previous month’s decline that had interrupted five straight months of gains. While the TSX Composite reached an intra-day record high of 22,554.98 on May 21, continued […]

Read more

May 2024 Portfolio Management Team Update

May 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth May 17, 2024 Market Review Global equities fell in April after five straight months of gains, as concerns about sticky inflation and receding optimism about interest rate cuts by the Federal Reserve sapped investor sentiment. However, markets have […]

Read more

April 2024 Portfolio Management Team Update

April 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 10, 2024 Market Review Global equities advanced for the fifth straight month in March, capping a stellar quarter for stocks and enabling the MSCI All-Country World Index to post a record high on the last trading day […]

Read more